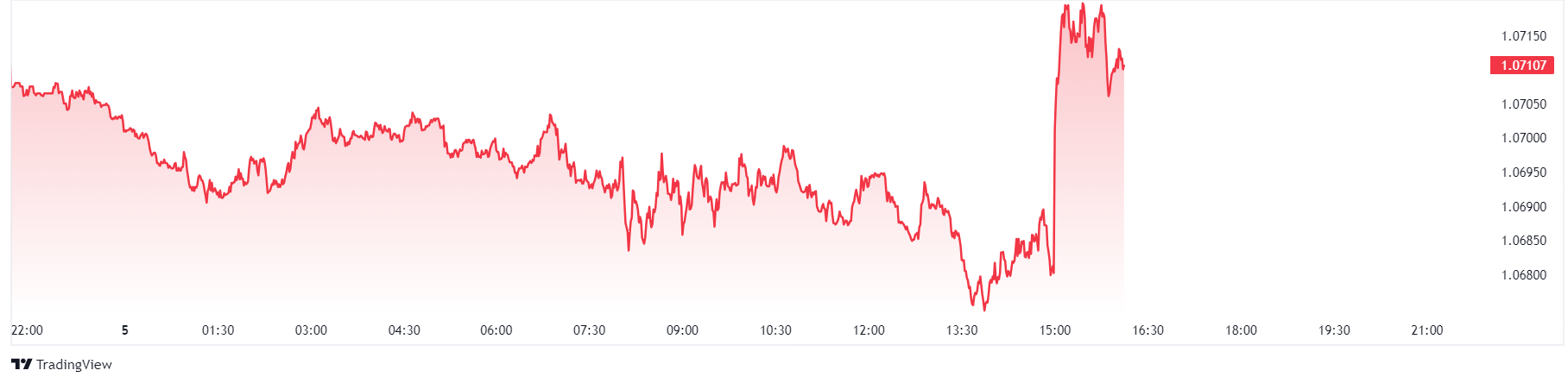

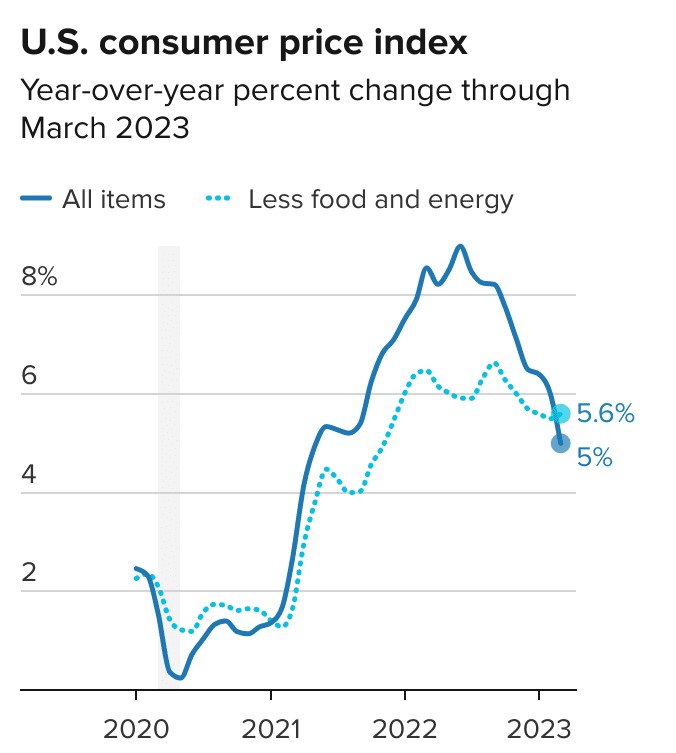

Stocks, gold and the EUR/USD surge as US inflation continue to slow, but optimism is fragile

Chris CammackMay 16, 2024 02:51 PM

After the CPI figures were released, the chances of a September rate cut increased to 72%, with a July rate cut not out of the question either, with a 35% chance.