What are CFDs?

CFDs are contracts between an individual trader and a broker to pay the price difference of an asset between opening a trading position and closing a trading position. For example, if you think the price of crude oil will rise and open a buy position, but the price falls instead and you close your position, you will make a loss. CFD traders are not concerned with the value of an asset they are trading, only the difference in price between opening and closing a trading position.

CFD trading dates back to the late 1970s and early 1980s when financial derivatives first emerged as a means for traders to speculate on the price movements of financial assets.

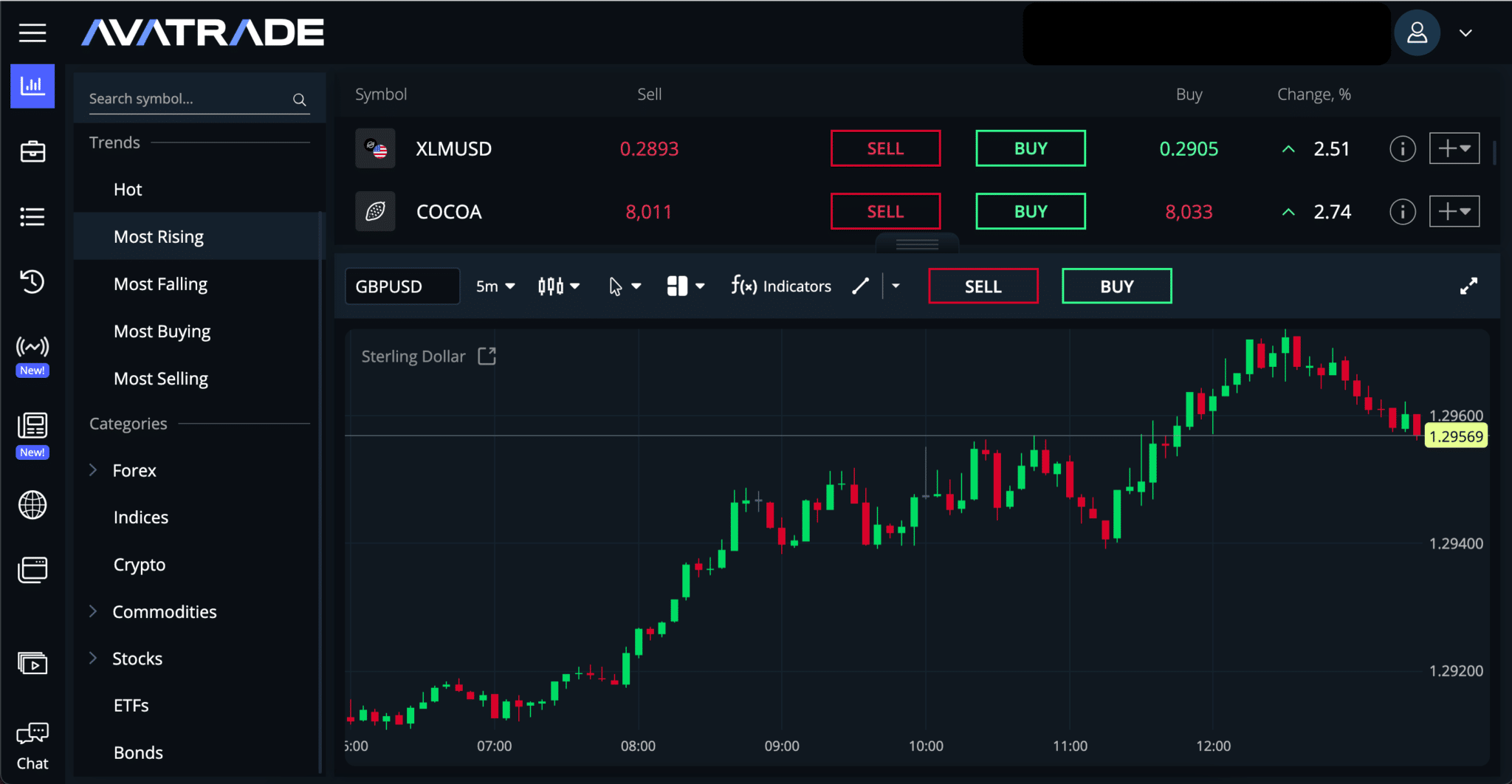

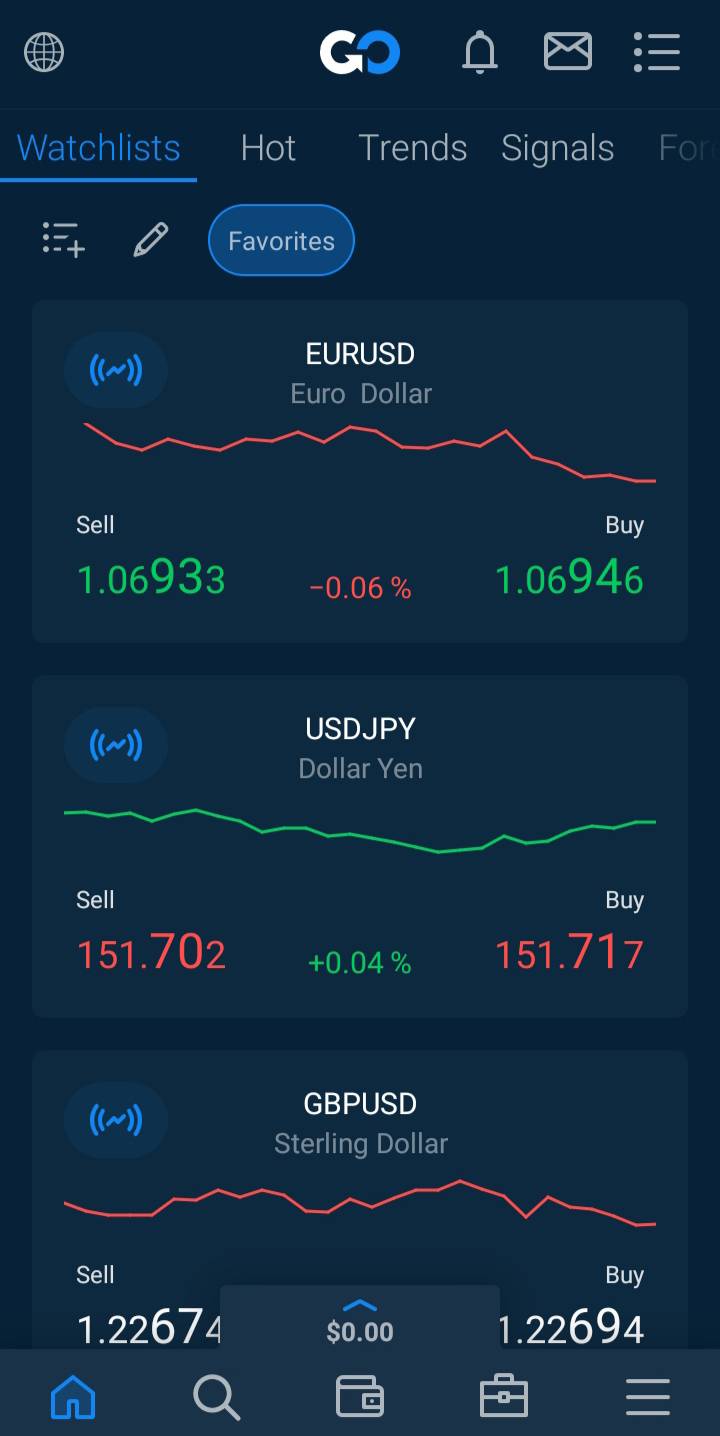

CFDs quickly gained popularity among professional traders because they provide a flexible and cost-effective way to trade a wide range of financial assets. In the following years, the development of online trading platforms made CFD trading accessible to retail traders, and since then, the industry has grown rapidly.

The Difference Between CFD Trading and Traditional Trading

The main difference between CFD trading and traditional trading is that when you trade a CFD, you are speculating on a market’s price without taking ownership of the underlying asset. With traditional trading, you take ownership of the underlying asset and may receive dividends on a regular cycle.

There are other differences between the two types of trading, with some that give CFD trading an advantage and some that make CFD trading more risky.

The Benefits of Trading CFDs

CFDs benefit from several features that make them valuable to individual traders:

Accessibility: CFD trading is often more accessible than traditional trading as it requires a smaller initial investment. For example, some CFD brokers have minimum deposit requirements of only 1 USD, which makes it easier for smaller investors to enter the market and start trading.

Leverage: Most CFD trading is leveraged trading, which means that traders only have to put up a small amount of capital to gain exposure to a large trading position. This is accomplished through the use of borrowed funds from the broker. For example, if a broker offers leverage of 20:1, the trader only has to put up 5% of the value of the trading position and can multiply his money 20 times over. Leverage can increase your profits, but it can also significantly increase your losses.

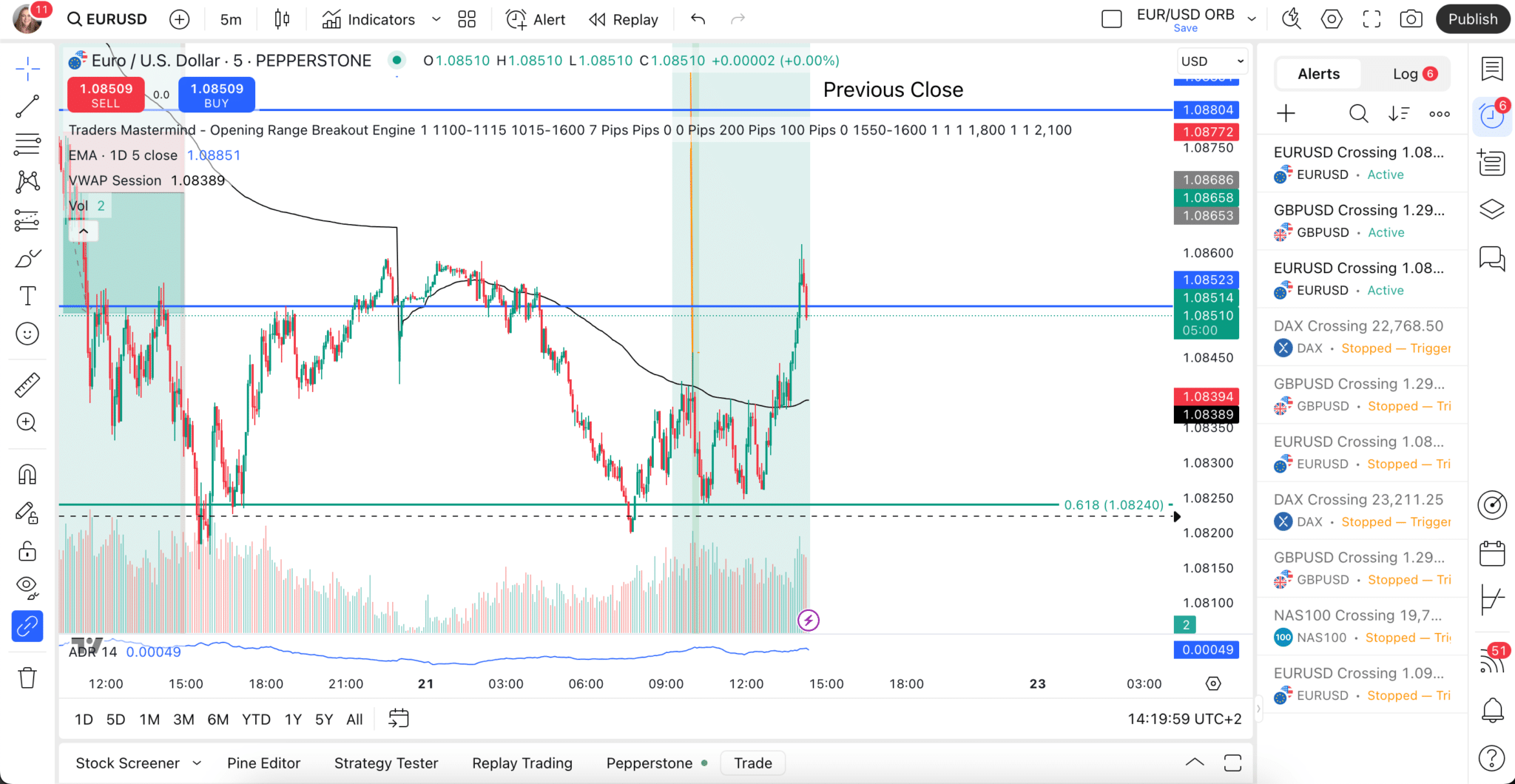

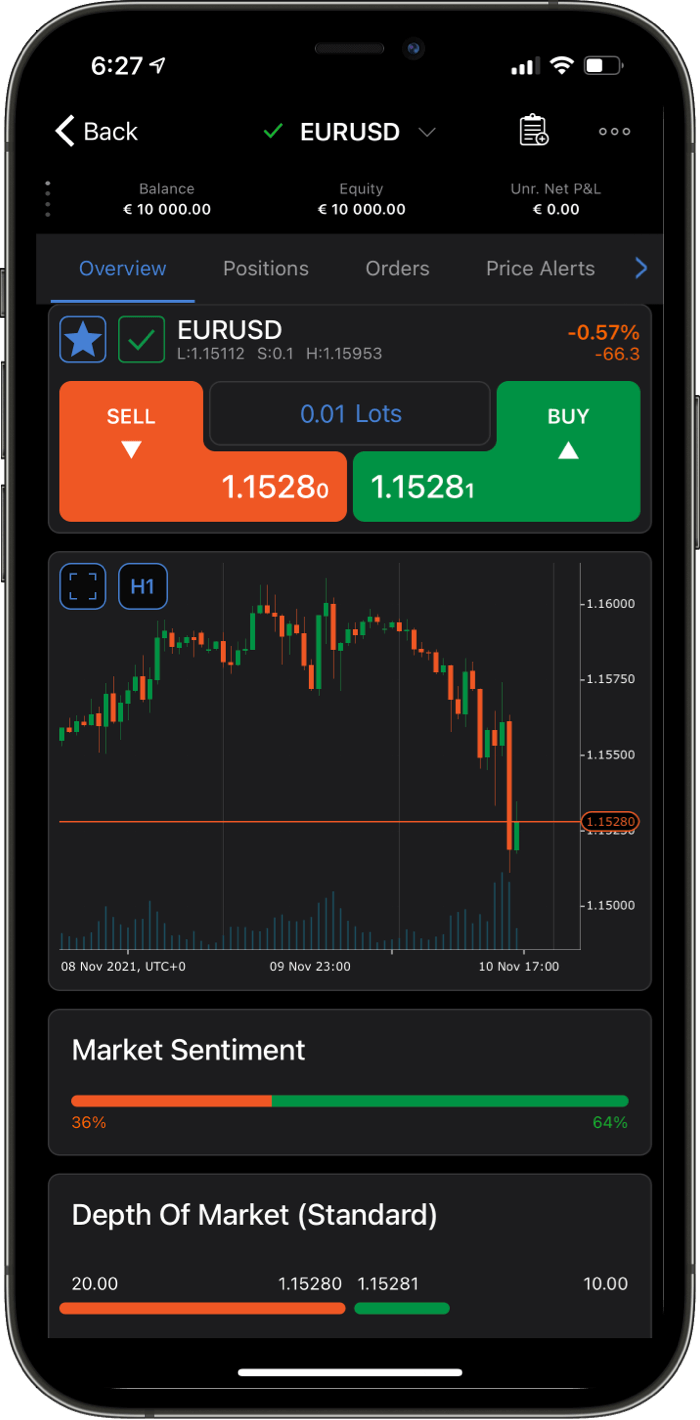

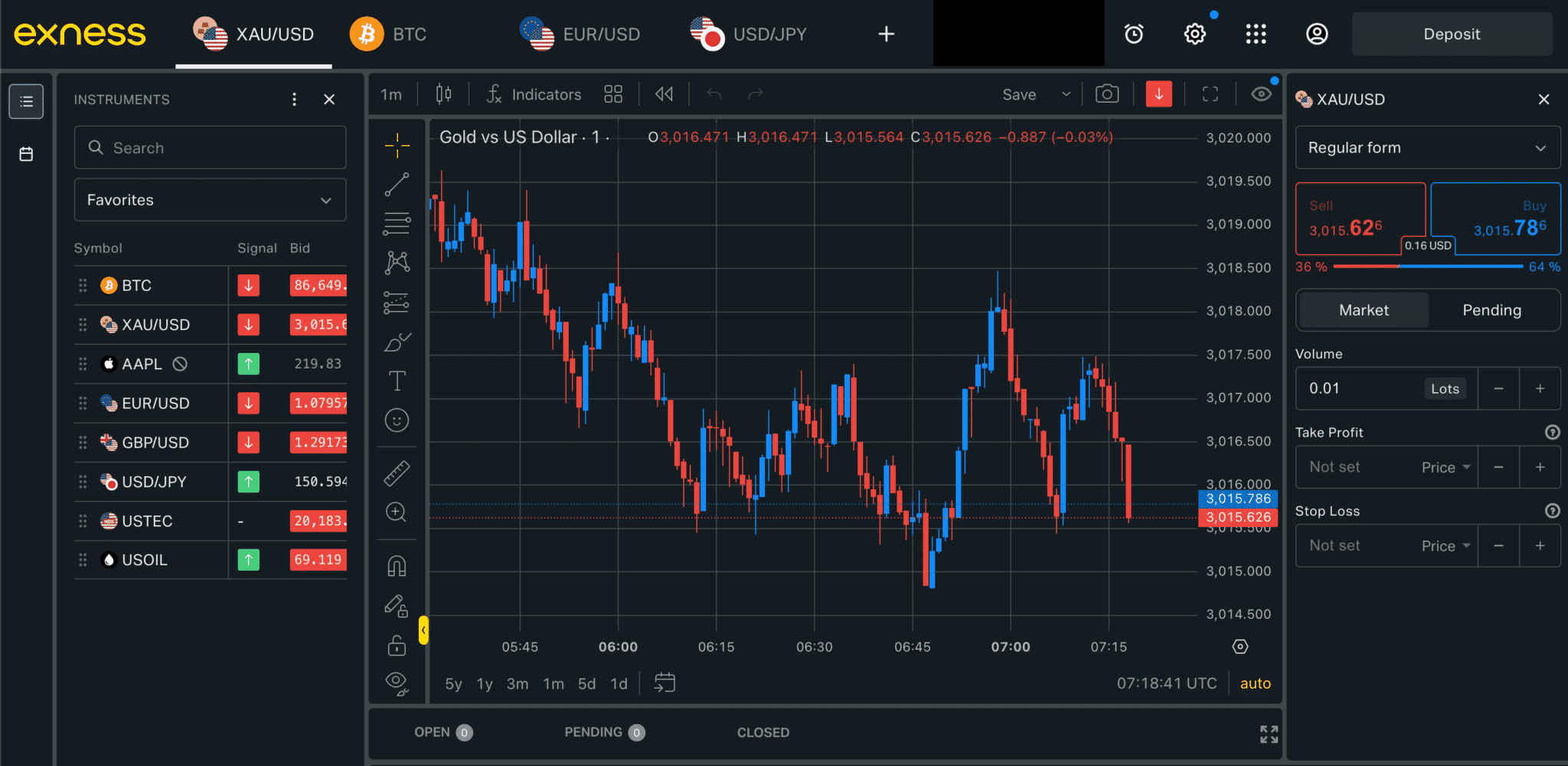

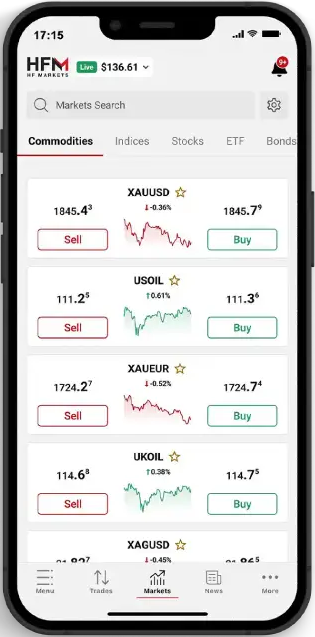

Profit from falling and rising markets: You can use CFDs to speculate that the price of an asset will rise (going “long”) or that it will fall (going “short”). Because CFDs are an agreement to pay the difference in the price of an asset, going short is very simple. You simply open a “sell” position and close it again once the price has fallen enough for you to make a profit.

Convenience: You can trade CFDs in many different assets without taking physical delivery, saving on storage, security and transportation costs. For example, you can trade CFDs in gold online and simply profit from price changes in the commodity without worrying about how you will store it securely.

Flexibility: You can close a position at any time during the trading day. That means you can hold a position for as long as you want, be it seconds, minutes or hours. You can even hold a position overnight, although there will be a charge for doing so. Many brokers also offer various options when it comes to trade size, allowing a wide range of traders to access the market.

Ability to hedge: Most people are familiar with the term “hedging your bets” and understand that it involves offsetting risks. Well, it means precisely the same thing in the financial world and is derived from the age-old idea of using a hedge – or fence – as a means of protection. In this instance, you can use CFDs to offset your trading positions by balancing trades in case your beliefs about whether those initial positions are likely to rise or fall prove wrong.

Exposure to a vast range of financial assets: You can use CFDs to gain exposure to thousands of underlying financial instruments worldwide from just one trading platform.

Why CFD trading can be risky

Like any other type of financial trading, CFD trading involves a high degree of risk. Some of the key risks associated with CFD trading include the following:

Market volatility: CFD markets are known for their volatility. Markets are influenced by political and economic events, and sudden shifts in these events can lead to rapid and substantial price movements.

Volatility can widen spread and costs: Severe volatility in markets or a particular product can cause brokers to widen spreads, affecting the prices paid by the trader when entering and exiting positions, potentially negatively impacting trades and increasing losses.

Leverage: CFD traders can use high levels of leverage to gain access to large trading positions, and while this can magnify potential gains, it can also magnify losses.

Constant monitoring: You must always be alert to possible changes in your position. Market volatility and rapid price changes – which could arise outside regular business hours if you are trading international markets – can cause the balance of your account to change quickly.

Lack of regulation: There are many unregulated CFD brokers in operation, which increases the risk of scams and unethical practices by some market participants.

Liquidity risk: CFD markets can experience periods of low liquidity, resulting in difficulty exiting a trade at an acceptable price.

Lack of ownership: Because you don’t own the underlying asset, you can’t gain from the benefits of ownership, such as the income provided at set periods by shares or bonds (like dividends).

It’s important for forex traders to educate themselves on the risks involved in CFD trading and to develop a solid risk management plan to help mitigate these risks.