Do I Need a Broker to Trade Forex?

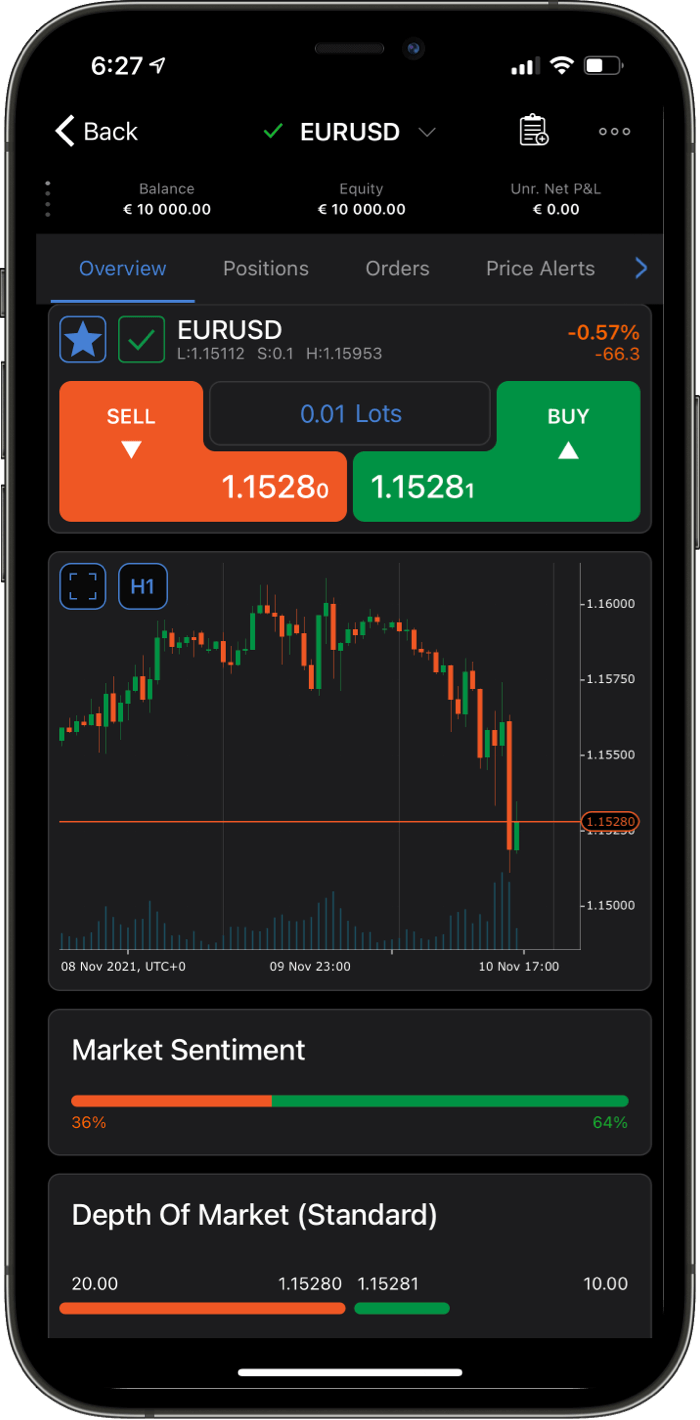

Yes, you will need a broker to trade Forex. Connecting traders to the Forex market is an expensive and technically complex business. Most Forex brokers form a bridge between the global Forex market and Forex traders; these are called market makers. Market makers buy up large trading positions from the Forex market, which they sell to traders in smaller trade sizes.

Other brokers act as a go-between, taking orders from traders and sending them straight to the global Forex market. These are called ECN brokers or DMA brokers. Both types of Forex brokers require a lot of money to set up and need teams of highly qualified technicians to maintain their trading platforms.

How do Forex Brokers Make Money?

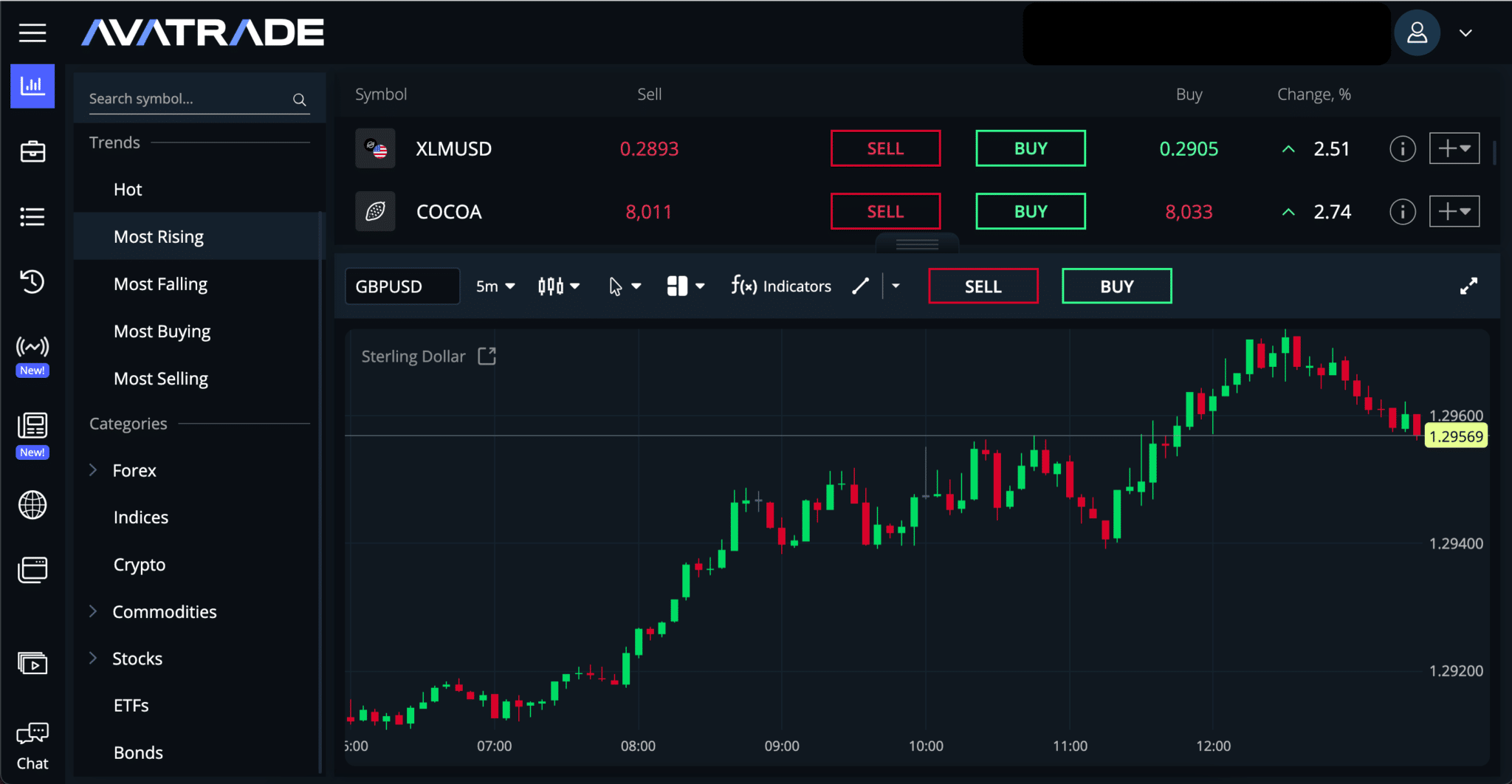

Market markers only make money from the spread – the difference between the buying and selling price of the currency pair. These brokers will be the counterparty to any trade, so they make money when clients lose trades.

ECNs have tight spreads but make money from commissions, which are charged every time a trade is opened or closed. This type of broker makes money whether a client wins or loses.

How Much Does It Cost to Trade Forex?

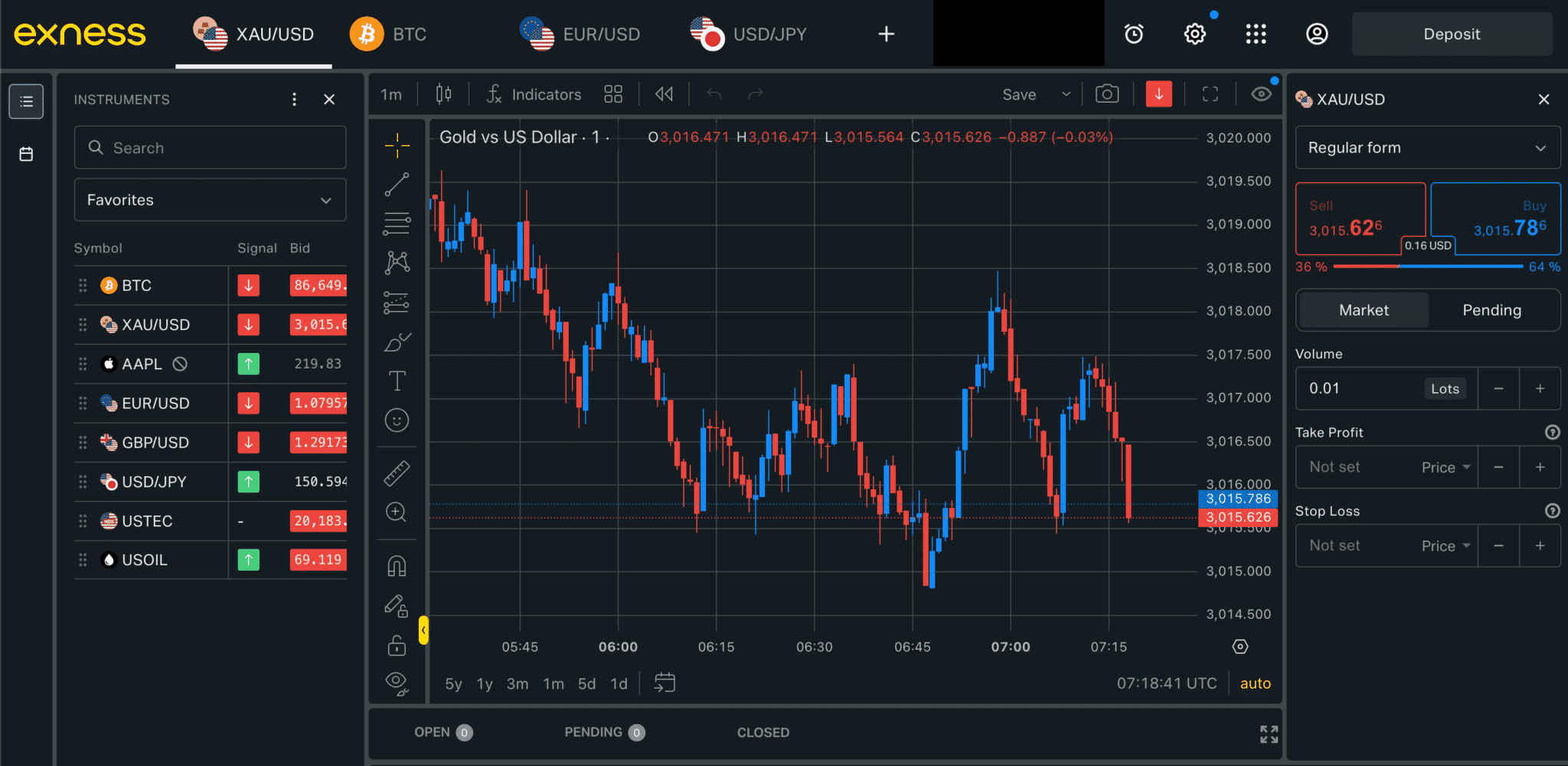

The cost of trading Forex varies depending on what you are trading, how much of it you are trading and how your broker charges you. The two common trading costs are the spread and the commission — these are fees that a Forex trader pays to use a broker’s services. It is important to understand and calculate your costs when trading Forex, as these costs will affect your overall profitability.

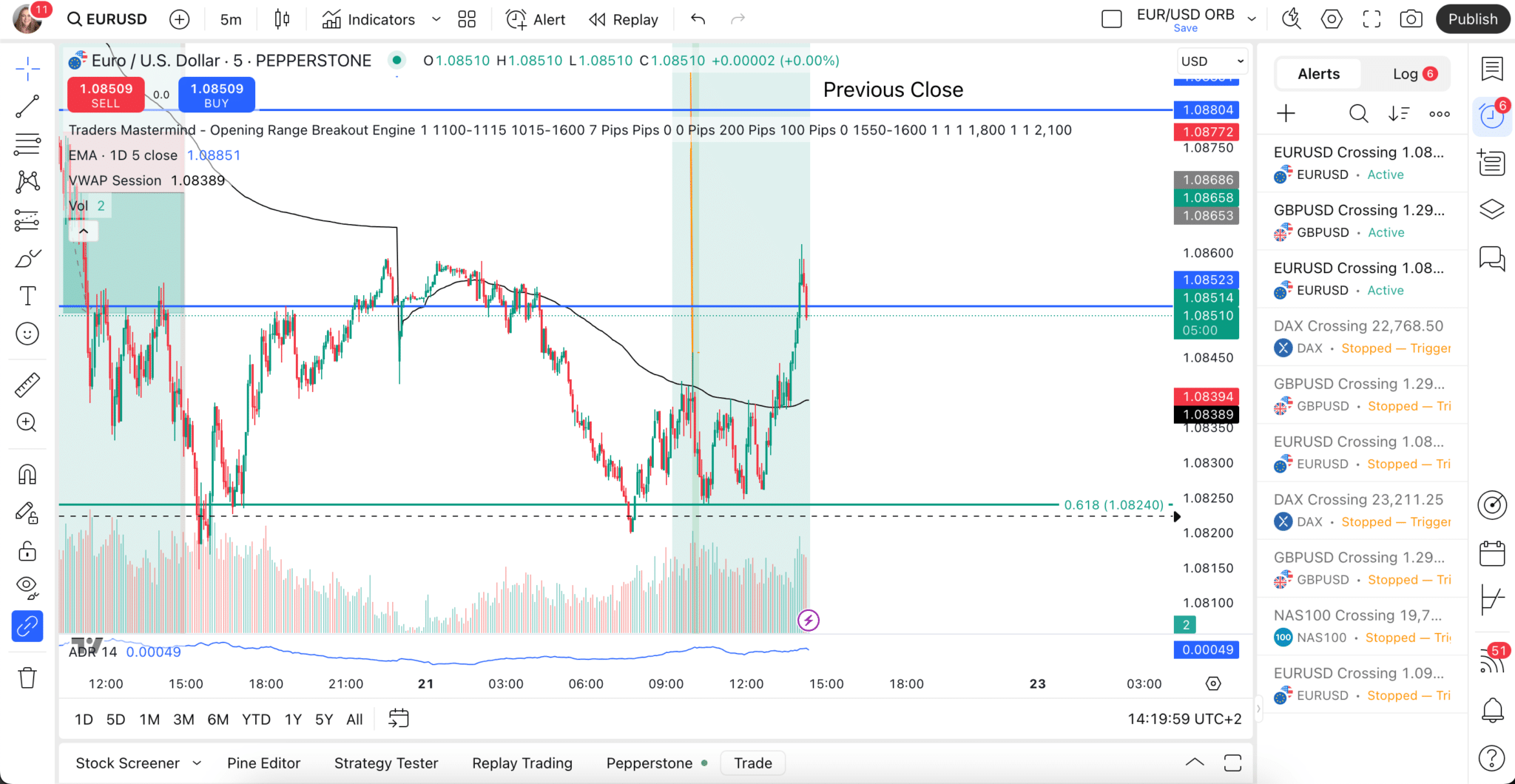

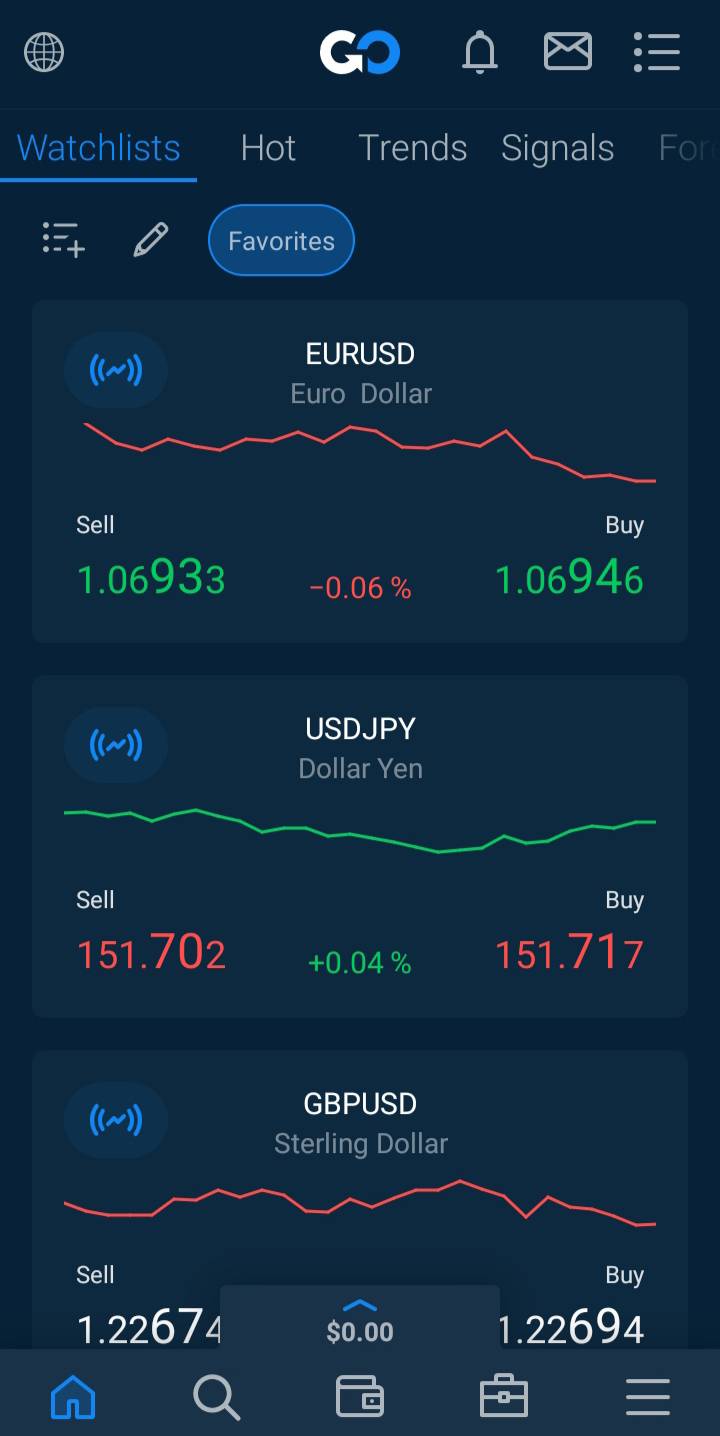

The spread is the difference between the buy price (also known as the offer or ask price) and the sell price (also known as the bid price) quoted for a currency. It can be either fixed or variable. The spread is measured in pips, with the industry average being around 1 pip on the EUR/USD, but higher for other currency pairs.

The commission is a fee, usually measured in USD, that is charged when you open and close a trade. The industry average is 3.50 USD per lot per side (7 USD round turn), but this often depends on the account type and platform you choose. Not all brokers charge a commission and instead have wider spreads.

To calculate the total cost, use a spread cost calculator, which are widely available for free on the Internet.

Read more about understanding your trading costs in Forex here.

Do Brokers Charge Other Fees?

Besides the trading costs, brokers could also charge other types of fees – often referred to as non-trading fees. These fees include swap/rollover fees (a fee your broker either credits or debits from your account balance whenever you keep a position open overnight), inactivity fees (charged to accounts when there’s been no trading activity for a certain amount of time) and fees for withdrawing funds.

Brokers often charge fees for additional paid services such as VPS (Virtual Private Server) hosting, premium trading signals, and access to exclusive versions of trading platforms, such as TradingView Plus or Premium.