XM's Market Analysis

Our review noted that XM’s market analysis section consists of a Markets Overview, News, XM Research, Trade Ideas, Technical Summaries, an Economic Calendar, XM TV, and a Podcast.

Markets Overview: Frequent articles by a third-party provider, Reuters, are available in this section and cover all the latest market news.

News: All the latest market news, also provided by Reuters, is updated a few times an hour.

XM Research: The XM Research team provides frequent articles covering technical analysis, Forex previews, market comment, financial markets, special reports, and stock market news.

Trade Ideas: Provided by a third party, namely Analyzzer, this section covers how the various instruments fare against one another.

Technical Summaries: This section covers the various trends among the XM’s instruments.

XM TV: Provided daily by XM’s in-house team of analysts, XM TV covers Forex News, Technical Analysis, and a Weekly Forex Outlook.

Podcast: XM’s trading podcast, Global Market Insights, provides traders with meaningful and informative content encompassing up-to-date information needed for online investing and updates on economic events across the globe.

Economic Calendar: XM offers a good economic calendar. It has a filter function where you can filter for countries, data type, and importance.

Overall, we found the research available at XM excellent.

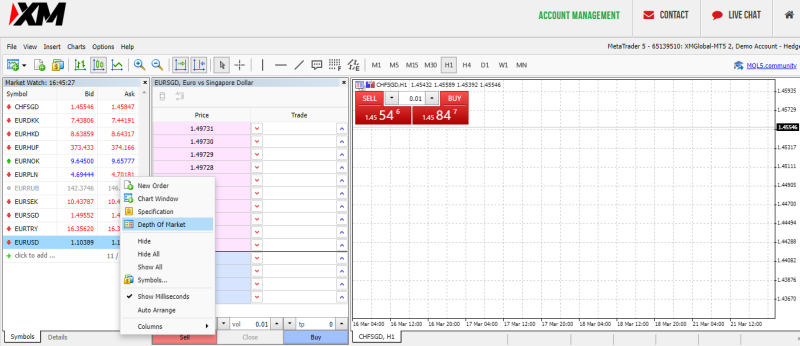

XM also offers several technical indicator tools to help guide traders in their trading decisions, including the following:

- Ribbon Indicator

- River Indicator

- Ichimoku Indicator

- Bollinger Bands

- ADX and PSAR Indicator

- Analyser Indicator

- MQL5

Unfortunately, XM doesn’t offer the popular third-party tools such as Autochartist or Trading Central, that are commonly available at other brokers.

Copy Trading

XM recently added copy trading to its repertoire. We really like XM’s copy trading service – there are a huge number of strategy providers to choose from, and traders can filter providers by performance, risk appetite, trading instrument, win-ratio, drawdown, and trading frequency, among others.