Although the concept of leverage is relatively easy to grasp, it is very often misused. It is essential for beginners to understand how it increases their risk in Forex trading and how to use it responsibly.

What is Leverage?

The textbook definition of leverage is using a smaller amount of capital to gain exposure to larger trading positions via the use of borrowed funds. In the case of Forex trading, money is usually borrowed from a Forex broker. Forex traders use leverage to profit from relatively small price changes in currency pairs.

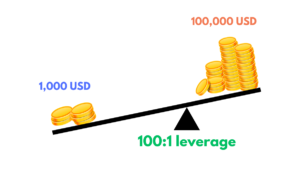

Leverage is always expressed as a ratio. For example, a leverage ratio of 100:1 means that the necessary margin required to open and maintain a position is one-hundredth of the transaction size. So, with 100:1 leverage, a trader would need 1,000 USD to control a position size of 100,000 USD.

One of the key advantages of trading Forex, as opposed to, say, stocks, is that you get much higher levels of leverage. While the leverage ratio may be as high as 500:1 in Forex, you can probably only find leverage of 5:1 in the stock market.

Why Do Traders Use Leverage?

Without leverage, Forex trading with small amounts of money (say 1000 USD or so) would not be very profitable because the price movements in Forex pairs are so small.

For example, if you open a trade with 1,000 USD without leverage, for every pip lost or gained, the theoretical loss or gain amounts to 0.10 USD. And if you trade on an instrument such as the EUR/USD, which has an average daily range of only around 70 pips, your maximum profit or loss will be only 7 USD.

However, if you use a leverage of 1:100 with a deposit of 1,000 USD, your position size is now 100,000 USD. For every pip movement, your theoretical loss or gain will now be 10 USD. Again, if you were trading on the EUR/USD and the market moved 70 pips in a day, you would stand to gain or lose 700 USD.

How Much Leverage Should I Use?

Traders should choose the level of leverage that makes them most comfortable. Beginner traders will likely be more conservative in their use of leverage, limiting it to 5:1 or 10:1 for Forex trading. Only once traders have more experience and know how to limit their losses should they move onto higher levels.

Some traders – such as professional scalpers – are comfortable with much higher risk and may even trade with very high leverage levels of up to 400:1 or 500:1. But professional traders tend to have rigorously tested risk management systems – and the extraordinary discipline needed to follow them to the letter.

For more information on how to choose the right leverage for your trading style and experience level, watch this video.

How to use Leverage in Forex trading

While leverage can increase your potential profits, it can also increase your potential losses. You can avoid the potentially negative impact of leverage by using risk-management tools provided by brokers.

These tools include stop-loss orders. You can set these orders automatically with your broker so that if a trade moves in the opposite direction to the one you expected, the trade is closed when it passes below a certain level. That limits your losses, effectively providing insurance against how much you can lose. While no trader sets out to lose money, it is best to have a means of keeping the losses small.

For more on this risk management tool and why it is essential for all Forex traders, read our article on stop-loss orders.

Other ways to manage risk when using leverage are to keep positions small and to limit the amount of capital for each position.

What is Margin?

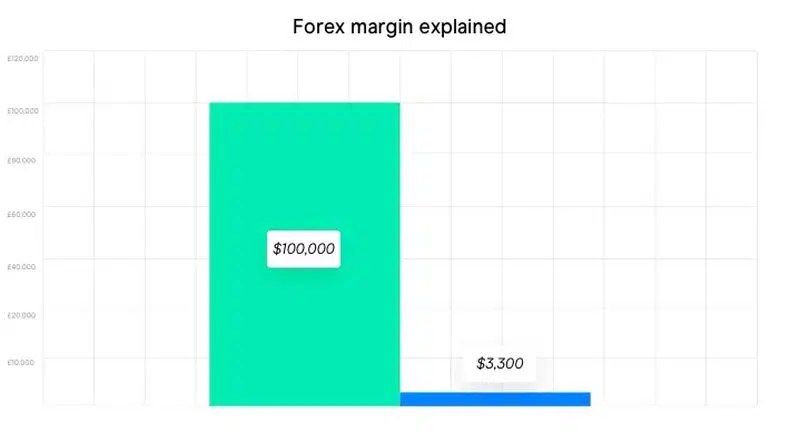

Another way of looking at leverage is by the amount of margin you need to open a trading position. So, if a broker allows you leverage of 30:1, you will be required to put up a margin, or deposit, of just 3.3% (or US$3300 to open a trade of US$100,000). A Forex margin of 10% equates to a leverage of 10:1, while a margin of 3.3% equates to 30:1 and so on.

Figure 1: How leverage allows you to turn capital of US$3300 into a trade worth 100,000 USD. Source: CMC Markets

You may have heard the phrase “margin call”. This occurs when the equity in your account – the total capital you have deposited, plus or minus any profits or losses – drops below your margin requirement. Should that occur, there is a risk that your positions will be automatically closed by your broker, locking in any losses, so margin calls should be avoided. That can be done by adding funds to your account or closing the trade sooner.

The margin level needs to be continuously monitored to avoid a margin call. Traders can also reduce the chance of margin calls by implementing risk-management techniques.

How to Calculate Leverage in Forex

Calculating leverage is very straightforward. You just need to use the formula below.

Leverage = 1/Margin = 100/Margin Percentage

Imagine, for example, you have U$10,000 in your trading account. With a margin of 1%, you are able to open positions to a total value of US$1,000,000 (US$10,000 ÷ 0.01 = US$1,000,000).

The Risks of Using Leverage

Leverage is a very appealing aspect of trading, as winnings can be multiplied immensely. But it is a double-edged sword, and losses can be multiplied just as easily.

Continuing with the example above, if you deposit 1,000 USD on a trade with a leverage of 1:100, which results in a position size of 100,000 USD, and the market goes against you by 70 pips, you would lose 700 USD, which is 70% of your initial deposit. However, if you hadn’t used leverage, you would have lost only 7 USD, which is 7% of your capital.

Traders should implement sound risk management strategies when trading on leverage.

Most Forex traders implement strict trading styles that include the use of stop-loss orders to limit potential losses. A stop-loss order is an instruction given to the broker specifying the maximum loss that can be incurred on a position. It ensures that your position is closed at a certain price level and prevents you from losing more than you can afford. In this way, you can restrict the losses on any trade.

Is there a limit on the Level of Leverage Brokers Can Offer?

Leverage varies from 1:20 up to 1:3000 depending on the broker and the regulation to which the broker adheres. Since 2018, regulators in the UK and Europe have introduced leverage restrictions to protect traders’ interests because beginner traders were losing so much money. As a result, FCA and CySEC-regulated brokers can only offer a maximum leverage of up to 30:1 on Forex pairs. In 2021, the Australian Securities and Investments Commission introduced a limit of 30:1, and the Securities Commission of the Bahamas introduced a limit of 200:1. In the years to come, we expect more regulators to follow suit.

Traders in Europe, the UK, or Australia looking to trade with higher leverage will have to find an offshore broker. Offshore brokers are often regulated by more relaxed authorities, such as Seychelles’ Financial Service Authority or the Financial Services Commission of Mauritius. Offshore brokers often allow leverage of 1:1000 and sometimes up to 1:3000.

What is Free Margin?

Free margin is the amount of money in a trading account that is available to open new positions. It can be calculated by subtracting the used margin from the total amount deposited in an account (the account equity) and adding or subtracting the unrealised profit or loss from any open positions. If you have an open position that is currently in profit, you can use this profit as an additional margin to open new positions on your trading account. If, for example, you have US$ 5,000 in your account and are in profit by a further US$ 5,000 in open trading positions, your free margin amounts to US$10,000.

Margin Calls and Liquidation

If the losses on an open trade reach a certain level, the broker may close the position to prevent more significant losses. The liquidation level is set where the margin ratio falls below a certain point (usually 20%, but this can vary).

Imagine you have an account balance of US$10,000 and open a position that requires a Forex margin of US$1,000.

The market moves against you, leading to an unrealised loss of $9,000, reducing your equity to US$1,000 (i.e. US$10,000 – US$9,000). Your equity is equal to your margin, meaning your Forex margin level is 100%. Consequently, you won´t be able to open any new positions on your account, unless the market turns around and your equity increases again or you deposit more cash into your account.

Now, suppose the market keeps moving against you. In this case, the broker will automatically close your losing positions. The limit at which the broker closes your positions is based on the margin level and is known as the stop-out level, which varies from broker to broker.

When the stop-out level is breached, the broker will close your positions in descending order, starting with the largest position first. Closing a position will release the used margin, which in turn will increase the Forex margin level, which may bring it back above the stop-out level. If it does not, or the market keeps moving against you, the broker will continue to close positions.

Leverage increases both profit potential and risk considerably.

Conclusion

Leverage can be used successfully and profitably with proper management. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry, and you will be able to use it skillfully to your advantage. The best way to learn how to use leverage is with a demo account, these can be opened for free at all good brokers. Demo accounts allow beginners to experiment with different levels of leverage without risking any money at all.