-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

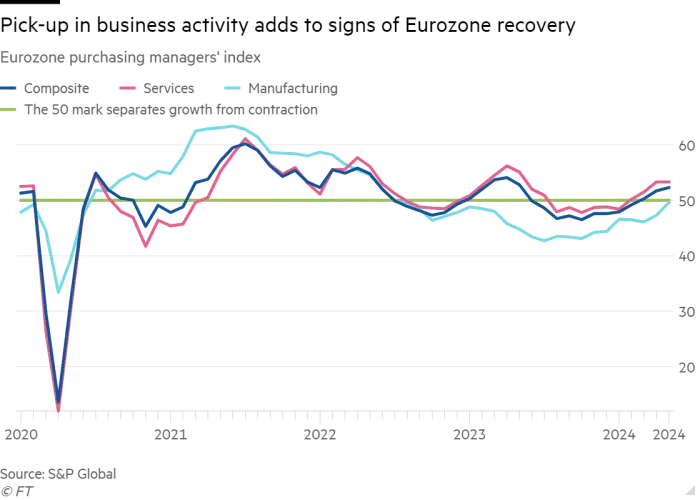

After a week of USD consolidation, the EUR/USD rebounded this morning, 23rd May 2024, as German and EU PMIs showed that the fragile economic recovery in the eurozone was gathering pace.

Source: Financial Times

While services remained relatively flat, strong growth in the manufacturing sector surprised analysts and injected optimism into markets. The EUR/USD responded in kind, breaking its losing streak and rising to 1.08440 before retracing.

However, the long-term outlook for a weaker EUR/USD remains unchanged, especially after the Federal Reserve minutes from 1 May’s FOMC meeting were released.

The minutes, released yesterday, showed that some committee members were not averse to increasing interest rates if inflationary pressure remained at elevated levels. While the chances of further tightening have abated in recent weeks, this highlights the committee’s nervousness over inflation.

“Participants discussed maintaining the current restrictive policy stance for longer should inflation not show signs of moving sustainably toward 2 per cent” the minutes said.

Federal Reserve Governor Christopher Waller on Tuesday said that while he does not expect the FOMC will have to raise rates, he warned that he will need to see “several months” of good data before voting to cut.

Should inflation continue to fall, futures markets expect two rate cuts this year – in September and November – but the overall theme is one of caution, and the resilience of the US economy may throw up further surprises in the coming months.

Meanwhile, the positive economic news from the eurozone should not change the European Central Bank’s view on a summer rate cut, with many analysts pencilling in a 25 basis point cut as early as next month.

If the ECB cuts rates sooner than the Fed, the pressure on the EUR will be immense and we can expect a weakening of the EUR/USD until interest rate parity is achieved – whenever that may be.

Technical analysis

Having broken below the ascending channel yesterday, price hovers just below channel resistance at 1.0844. Riding above all three moving averages and with the RSI sitting at 58, the outlook for the EUR/USD is bullish in the short-term.

However, on further upside moves the pair will face significant resistance at the 1.0866 level – where the 38.2% Fibonacci level of the December 2023 – February 2024 downtrend and the trendline intersect. The May top of 1.0894 will be the second major resistance point. Should the downtrend resume, supported by the possibility of the ECB cutting rates before the Fed, the 1.0800 psychological handle would come into focus, corresponding with the 100 and 200-day EMAs (pink and purple). Below that, the 1.0743 level is one to watch out for.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.