Market Analysis

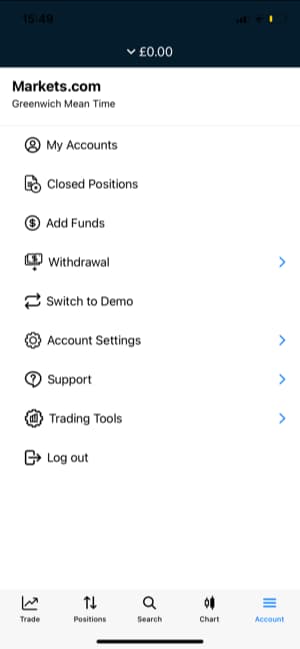

Markets.com offers excellent research materials compared to other brokers, including advance charting, an economic calendar, exclusive analysis and commentary, and an updated news section.

Top financial analysts and industry leaders deliver exclusive analysis and commentary on the web platform’s integrated video streaming service. Traders can access the latest news and views on the major markets and biggest economic developments, technical analysis, company earnings, and more. Markets.com account holders often get exclusive access to the latest training and strategies from top educational providers.

News: On top of a packed schedule of regular shows, Markets.com brings you exclusive live coverage of key events, such as central bank decisions and the US nonfarm payrolls reports, as well as political news and breaking market developments.

Knowledge Centre: The Knowledge Centre contains video tutorials on using the platform’s features and tools, as well as MARKETS View – where you’ll find the latest commentary and analysis.

Notifications: Traders can also stay on top of the events and market developments with rolling market coverage via push and in-platform messages and email.

Week Ahead Briefing: Prepare for the coming week’s trading with the Week Ahead briefing, delivered to your inbox every Sunday, and download in-depth guides on top markets to bolster your knowledge.

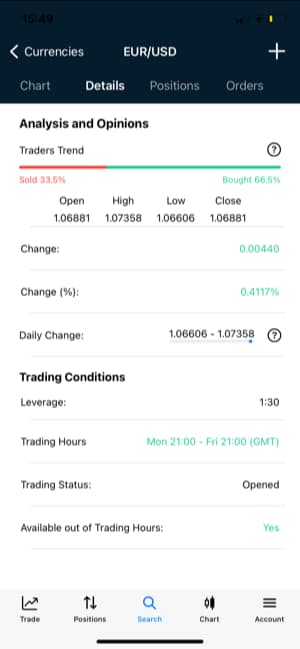

Charting Tools: Markets.com provides excellent charting tools, to which traders can add over 80 technical indicators.

Economic Calendar: Markets.com’s economic calendar allows traders to access predictions, trends, and analyses.

Overall, Markets.com has an excellent analysis section, written or curated by Forex experts, and full of detailed and interesting leads for new trading opportunities. While similarly high-quality market analysis can be found at other brokers, it is rarely in combination with the low trading costs found at Markets.com.