Getting Started with MT4

Setting up MetaTrader 4 is straightforward, and most brokers make the process beginner-friendly. A demo account is the safest way to learn the platform before trading real money.

1. Choose a Regulated MT4 Broker

Select a well-regulated broker offering tight spreads, fast execution, and strong oversight. Your broker—not MT4—determines your trading conditions.

2. Open a Demo or Live Account

A free MT4 demo account mirrors real market conditions and helps you practise placing trades, managing risk, and navigating the platform.

3. Download or Access MT4

MT4 is available in three main formats:

- Desktop (Windows): Full functionality, including EAs and custom indicators.

- WebTrader: Browser-based access with no installation required.

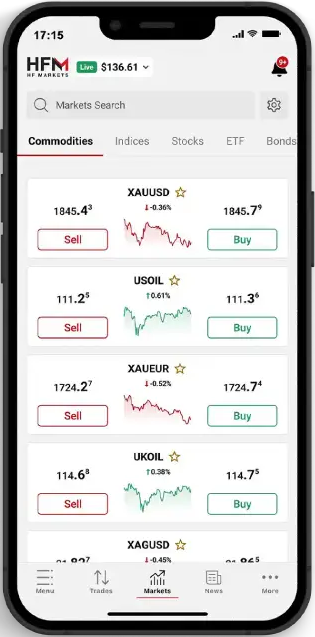

- Mobile (Android): Ideal for monitoring and managing trades on the go.

Your broker will provide the correct download links and server settings.

4. Log In With Broker Credentials

MT4 accounts are created by your broker. Use the login details in the welcome email to connect your MT4 terminal.

5. Learn the Fundamentals

Get familiar with:

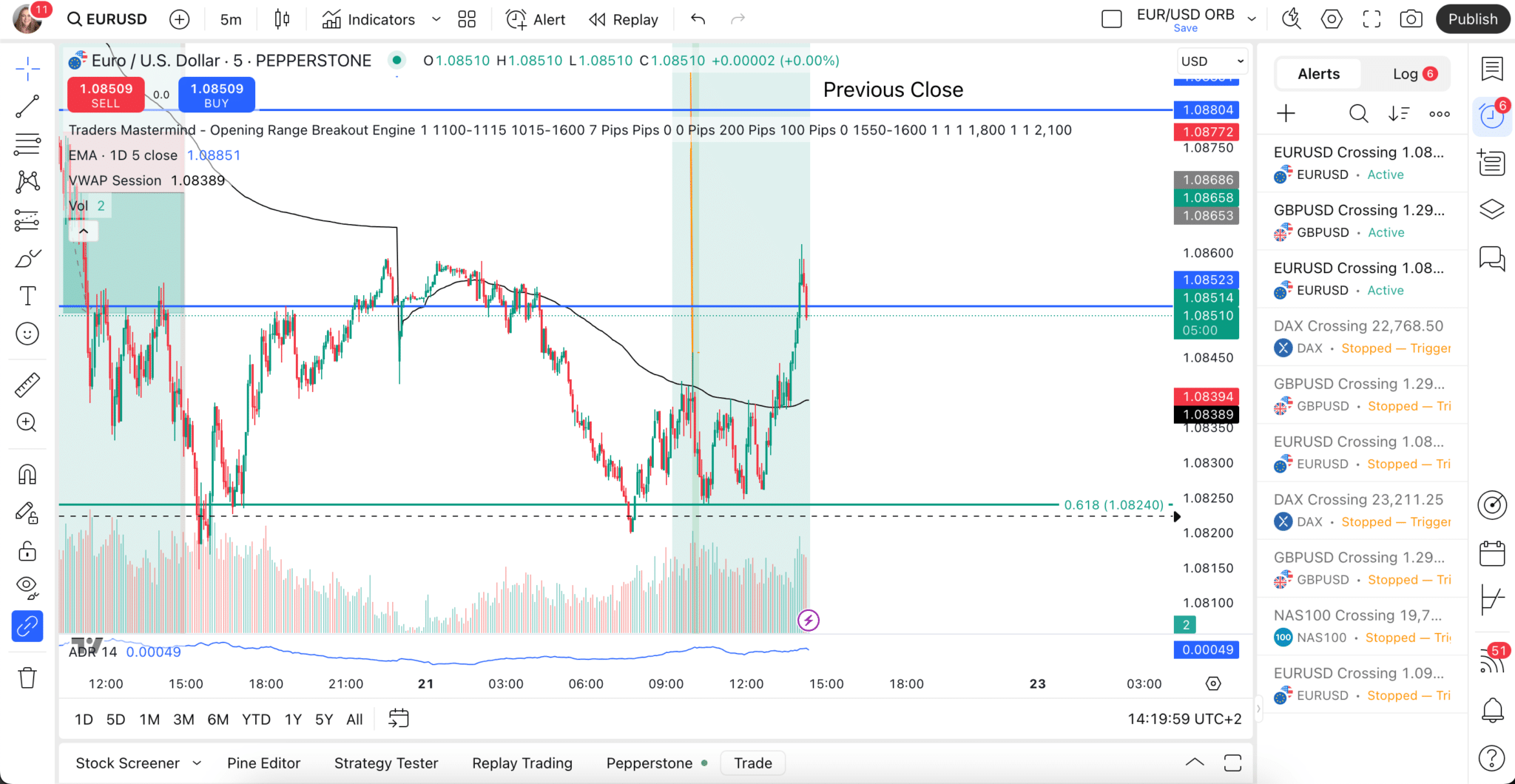

- Switching chart types and timeframes

- Adding indicators and drawing tools

- Placing and modifying market and pending orders

- Using stop-loss and take-profit levels

- Saving templates and layouts

Practise on demo first. When going live, start small and scale up as your confidence grows.

Copy Trading on MT4

MT4 supports copy trading through its built-in Signals service and third-party integrations.

How copy trading works:

- Choose a verified signal provider based on performance and risk.

- Set your preferred lot size and risk parameters.

- MT4 automatically mirrors the provider’s trades in real time.

- Pause, adjust, or stop copying whenever you like.

Copy trading is useful for learning from experienced traders, but results are not guaranteed. Always review a provider’s history and risk profile.

Automated Trading with Expert Advisors (EAs)

Expert Advisors allow MT4 to run automated strategies written in MQL4. EAs can analyse markets, open trades, and manage positions without manual input.

Key EA features:

- Write or customise EAs using MQL4.

- Install free or paid EAs from the MT4 Marketplace.

- Use MT4’s Strategy Tester to backtest strategies with historical data.

- Run EAs continuously on your device or a VPS.

Automated trading requires supervision. Poorly designed EAs can be risky, and markets can behave unpredictably. Always test EAs on a demo account first.

Disadvantages of MT4

While MT4 is still the most widely used Forex trading platform, it has notable limitations:

- Outdated design: The interface feels dated compared to MT5, cTrader, and TradingView.

- Forex-focused: Limited native support for multi-asset trading.

- No native Mac app: Requires workarounds or the web version on Mac.

- Basic backtesting: Single-threaded testing is slower and less precise than MT5’s.

- Fewer order types and timeframes: Restrictive for advanced strategy development.

- Ecosystem shifting toward MT5: Many new tools are released in MQL5 only.

- Minimal ongoing updates: MT4 receives limited development attention from MetaQuotes.

Costs of Using MT4

The MT4 software is free, but trading on it involves several broker-controlled costs:

- Spreads: The difference between bid and ask; crucial for active traders.

- Commissions: Common on ECN/raw accounts with tighter spreads.

- Swap fees: Overnight financing costs, which may be positive or negative.

- Non-trading fees: Withdrawal, inactivity, or currency conversion fees.

- Optional extras: Paid EAs, premium indicators, VPS hosting, and data feeds.

Your total trading cost depends far more on your broker than on the platform itself.

How to Choose an MT4 Forex Broker

Since most brokers offer MT4, key differences come from regulation, pricing, and execution.

1. Regulation and Safety

Choose brokers regulated by authorities such as FCA, ASIC, CySEC, or MAS. Strong regulation ensures client-fund protection and transparent operations.

2. Trading Costs

Compare spreads, commissions, and swap rates—especially on the instruments you trade most.

3. Execution Quality

Execution is entirely broker-dependent. Look for stable, low-slippage execution on ECN, STP, or DMA-style accounts.

4. Account Types and Minimum Deposits

Select between Standard, Raw/ECN, micro/cent, or Islamic accounts based on your strategy and deposit size.

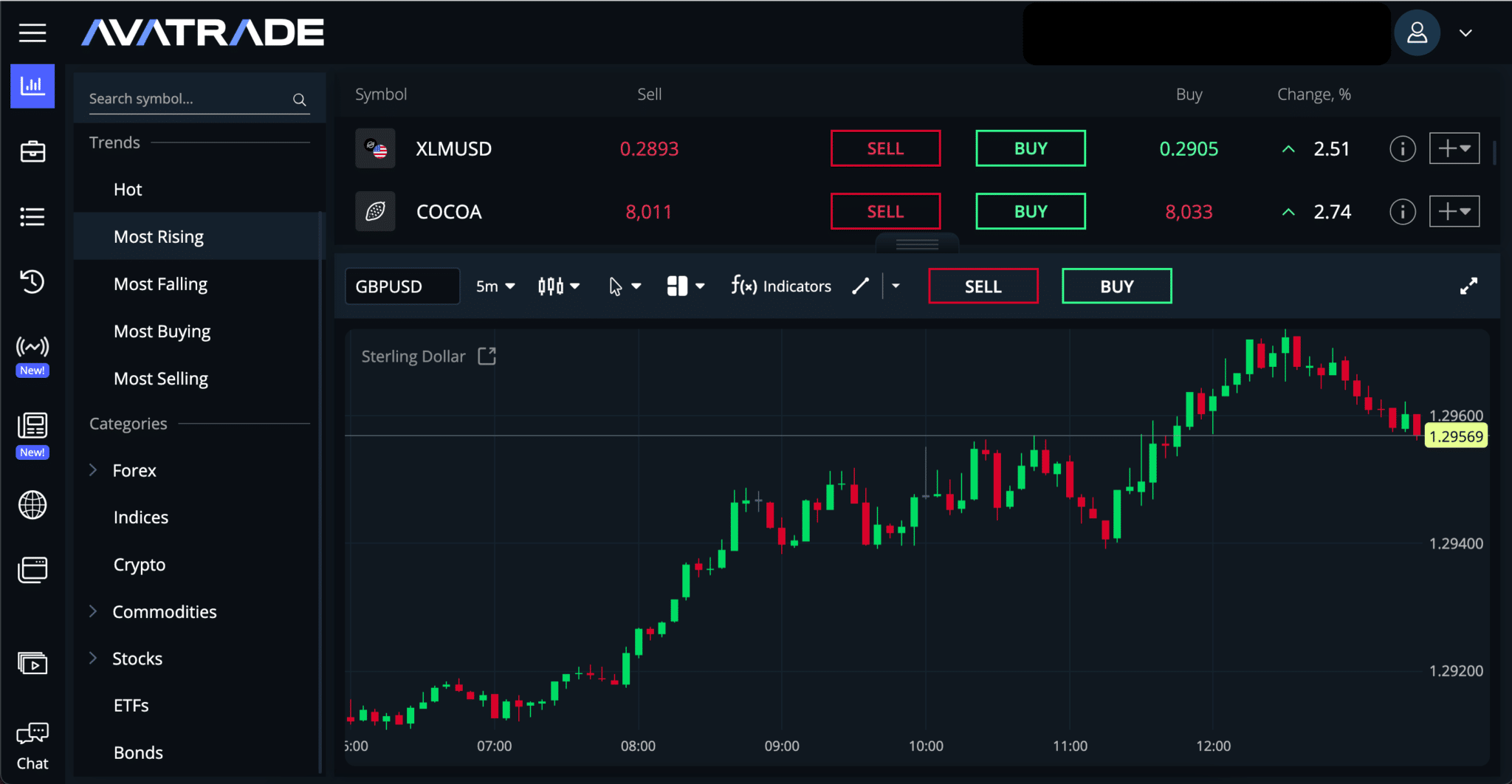

5. MT4 Enhancements

Some brokers offer upgraded MT4 tools, such as custom indicators, trading utilities, or VPS services.

6. Platform Access

Ensure the broker supports the MT4 formats you need—desktop (essential for EAs), WebTrader, and mobile.

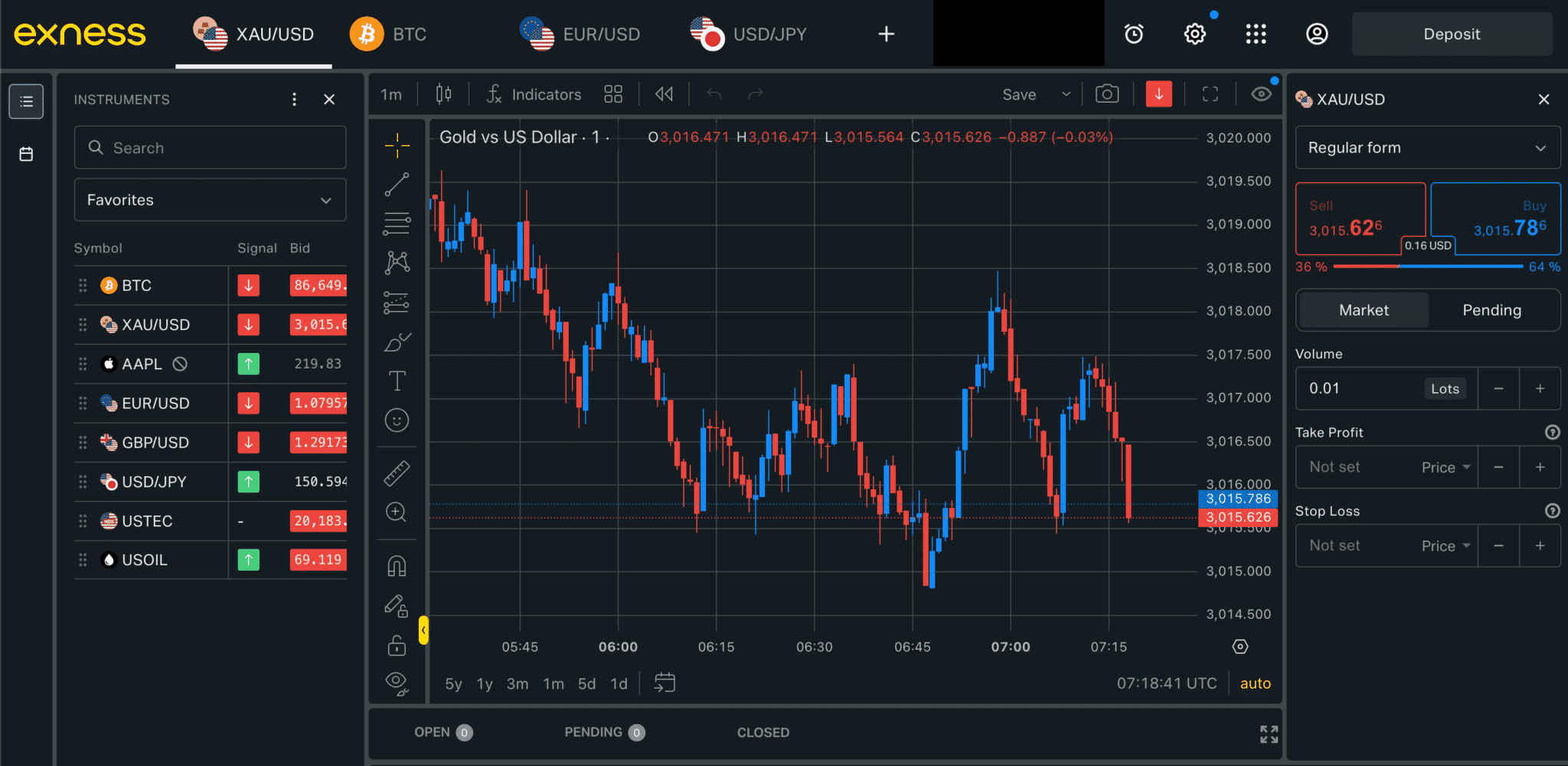

Platform Availability: Desktop, Web, and Mobile

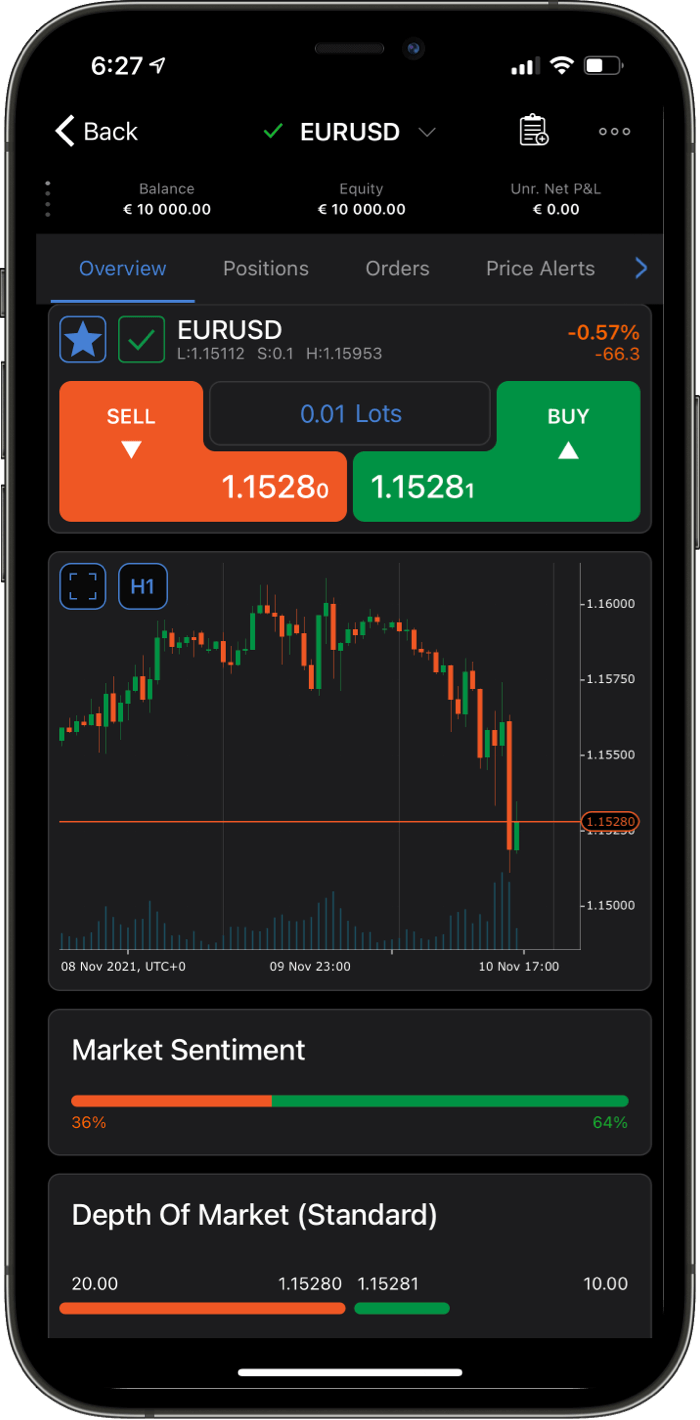

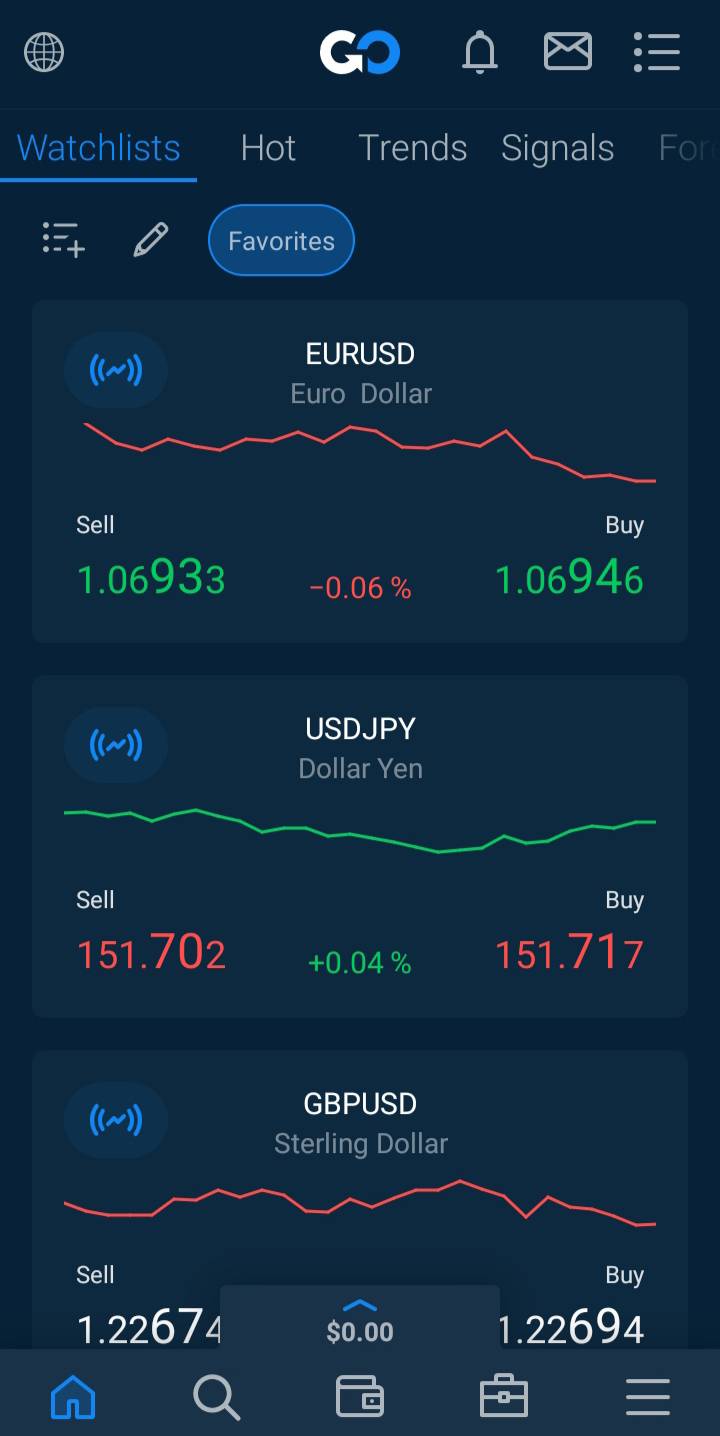

MT4 works across multiple devices, though each version offers different capabilities.

- Desktop (Windows): Full MT4 functionality, including EAs, custom indicators, and backtesting.

- Desktop (Mac): No native app; requires workarounds or the web version.

- WebTrader: Accessible from any browser but does not support EAs or custom indicators.

- Mobile (Android): Suitable for monitoring and simple trade management; not ideal for deep analysis.

The desktop version remains the most powerful and flexible option.

Final Thoughts

Despite its age, MetaTrader 4 remains the leading platform for retail Forex traders thanks to its stability, fast execution, and strong technical analysis tools. Its huge ecosystem of EAs, indicators, and community resources continues to set it apart from newer platforms.

However, MT4 is only as effective as the broker you use. Regulation, spreads, execution quality, and support ultimately determine your trading conditions. With a well-regulated broker and disciplined risk management, MT4 remains a reliable and versatile choice for traders of all experience levels in 2025.