What is a spread?

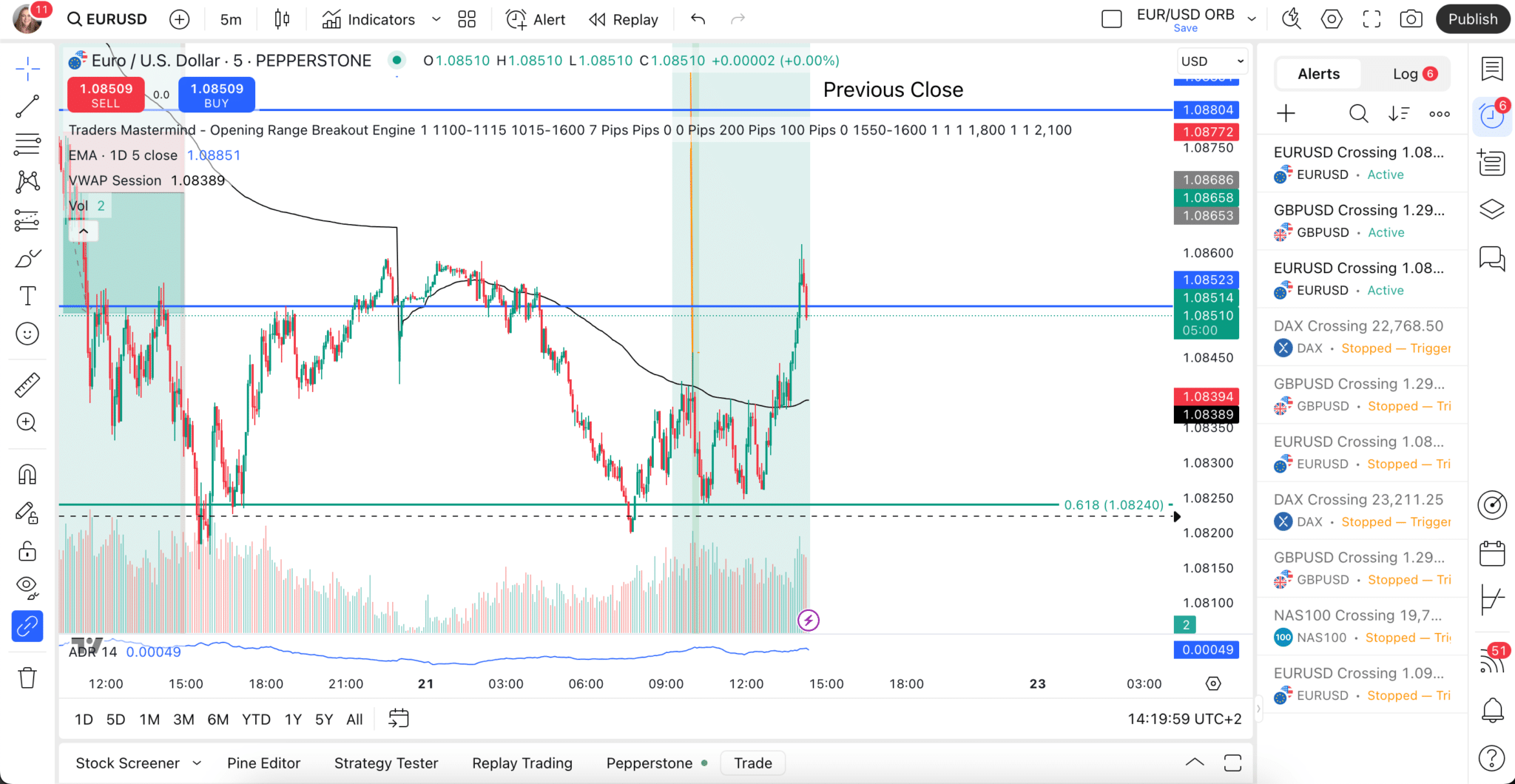

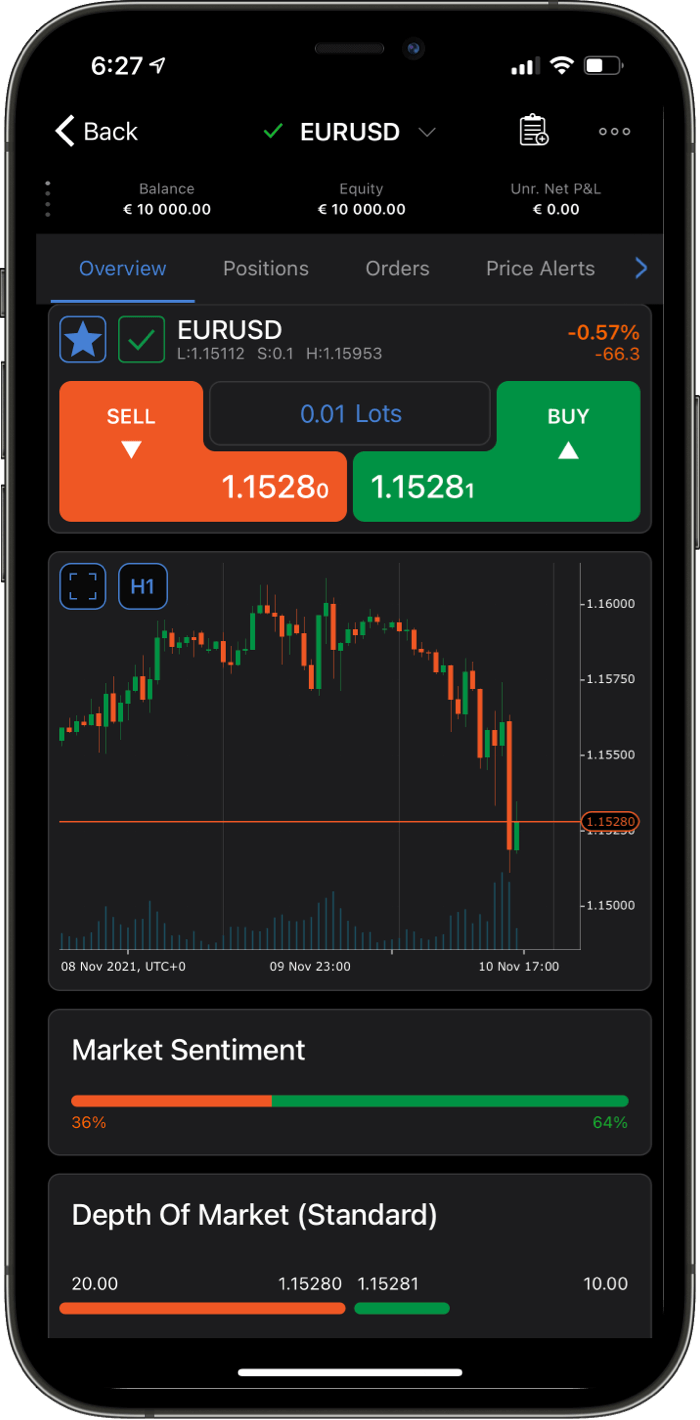

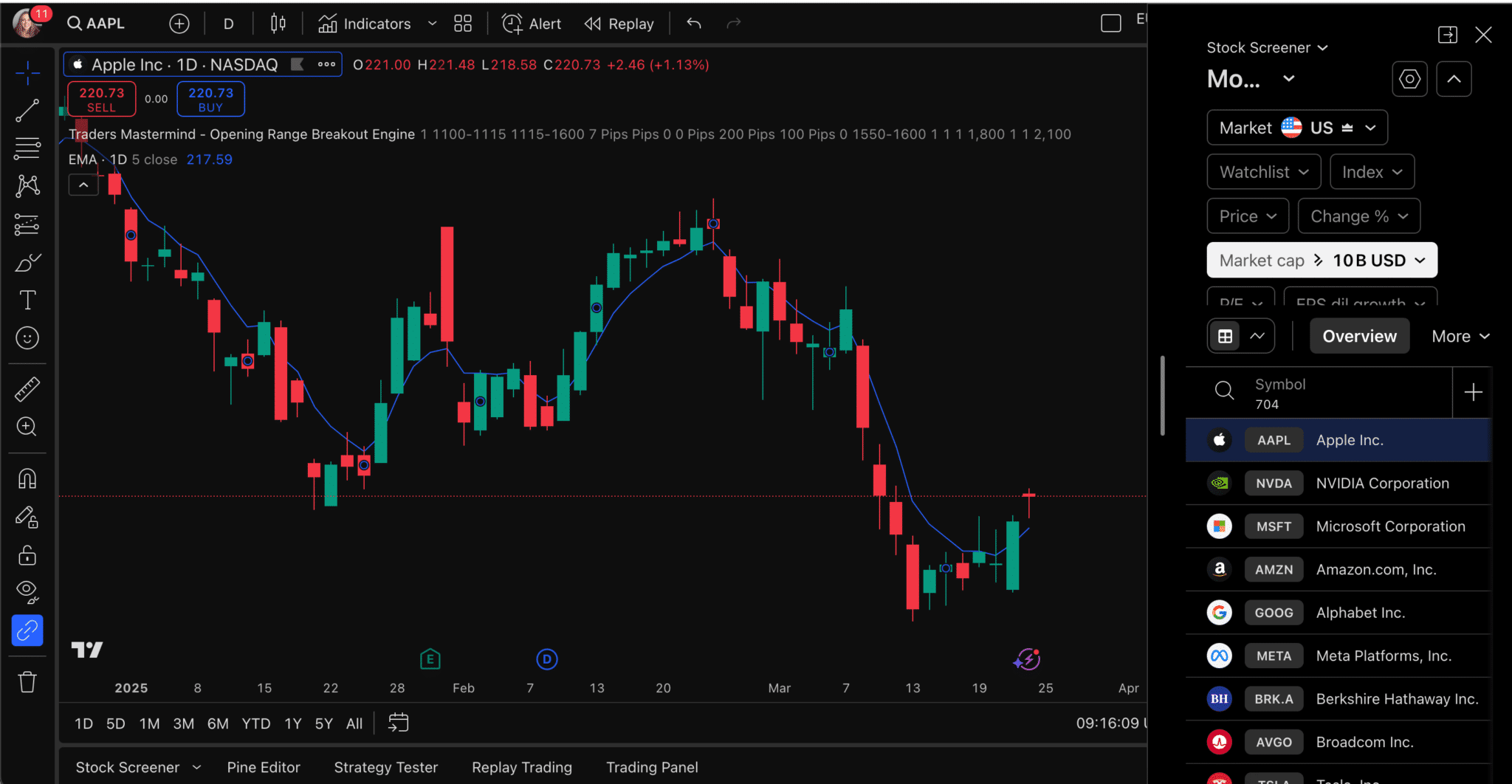

The spread is the difference between the broker’s buy and sell prices when trading a Forex pair.

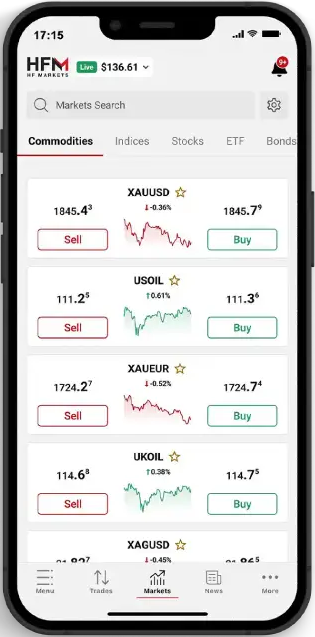

In other words, the spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). Brokers charge spreads as a fee for enabling the trades. In a typical trading environment, spreads vary depending on market conditions, the liquidity of the currency pair, and the broker’s pricing model. While major currency pairs, such as EUR/USD or USD/JPY, tend to have tighter spreads due to high liquidity, exotic pairs like USD/ZAR usually have wider spreads.

Understanding the spread is one of the first and most important concepts in Forex trading. The tighter the spread, the less price movement is required for a trade to become profitable.

Why are low spreads important?

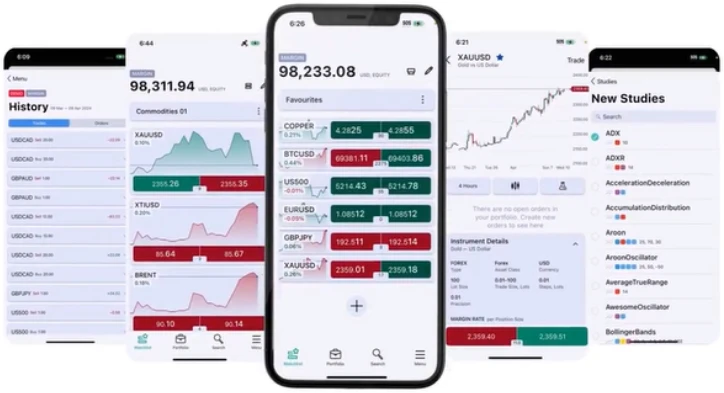

- Cost Reduction: Low spreads can help traders to reduce their trading costs. Each time a trade is executed, the trader has to overcome the spread cost to get into a profitable position. The lower the spread, the less the price needs to move in the trader’s favour before they start to make a profit, and the more the price can move against the trader before they start to incur a loss.

- Higher Frequency Trading: Traders, especially those using high-frequency trading strategies like scalping and day trading, must enter and exit the markets frequently. Lower spreads mean they pay less to execute these trades.

- Increased Potential Profits: When the spread is lower, the distance to a profitable trade decreases. This can potentially increase a trader’s profitability, especially in volatile markets.

How do brokers with low spreads make money?

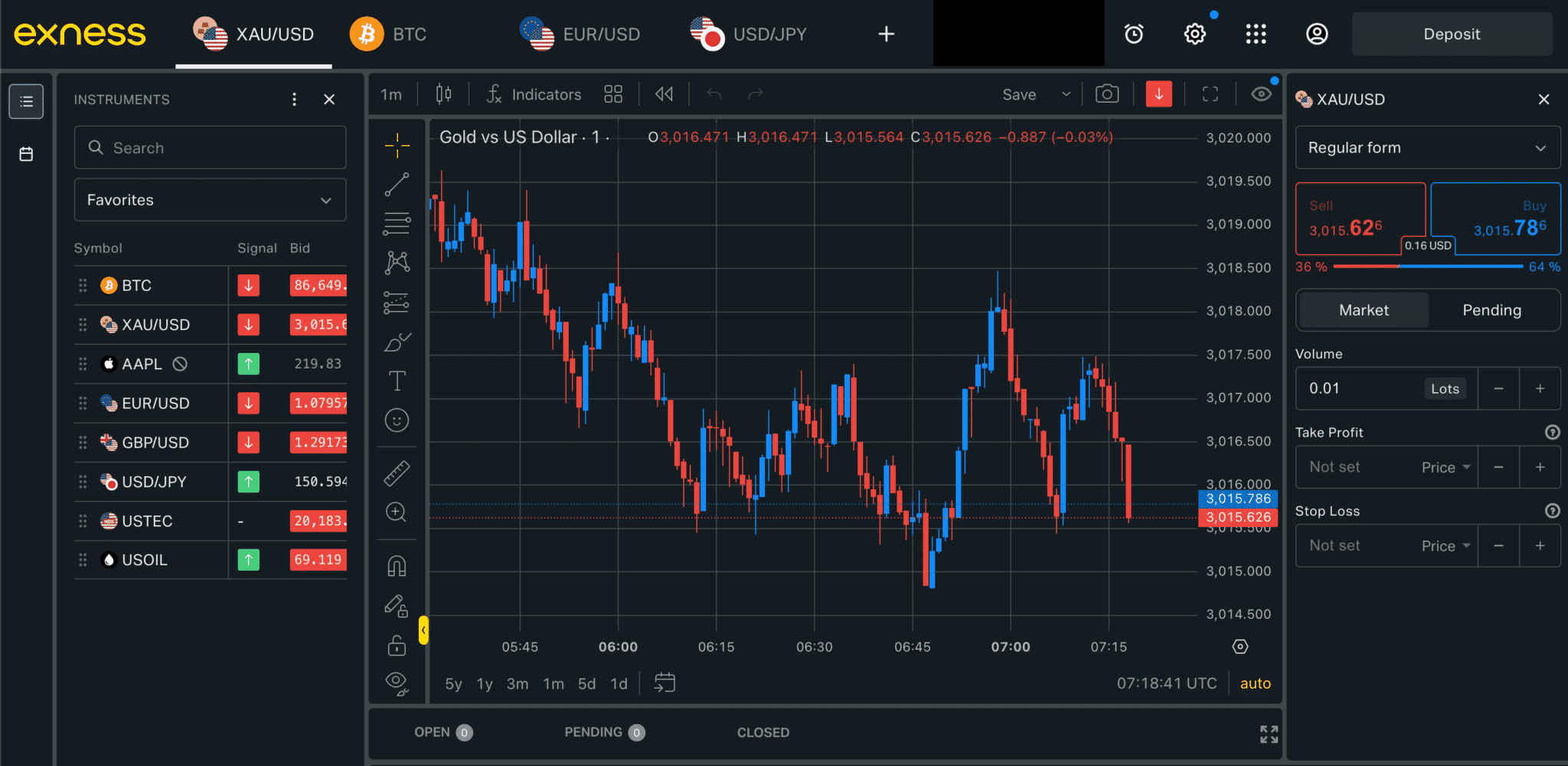

Most Forex brokers generate revenue either through spreads or commissions. A broker that offers low or zero spreads typically compensates for this by charging a fixed commission on each trade. These commissions are usually calculated per traded lot and can range from US$3 to US$7 per round turn (opening and closing a position).

For example, a broker might offer a 0.0 pip spread on EUR/USD but charge a commission of 6 USD per lot traded. This pricing model is commonly used by ECN (Electronic Communication Network) or STP (Straight Through Processing) brokers, who pass client trades directly to liquidity providers without intervention. The commission can be seen as a fee for the broker’s service of facilitating the trade. For a broker offering low or even zero spreads, the commission may be their primary source of income.

The commission-based model offers more transparent pricing, especially for Zambian traders comparing different brokers side by side. But it also means that the total trading cost is not always obvious at first glance, particularly for newer traders.