What Is an Islamic Forex Account?

An Islamic Forex account is a swap-free trading account that does not charge or pay interest on overnight positions. It is designed to comply with Shari’ah by removing riba and promoting shared risk between the trader and broker.

Key Features of an Islamic Account:

- No interest (riba) on overnight positions

- No hidden charges that replicate interest

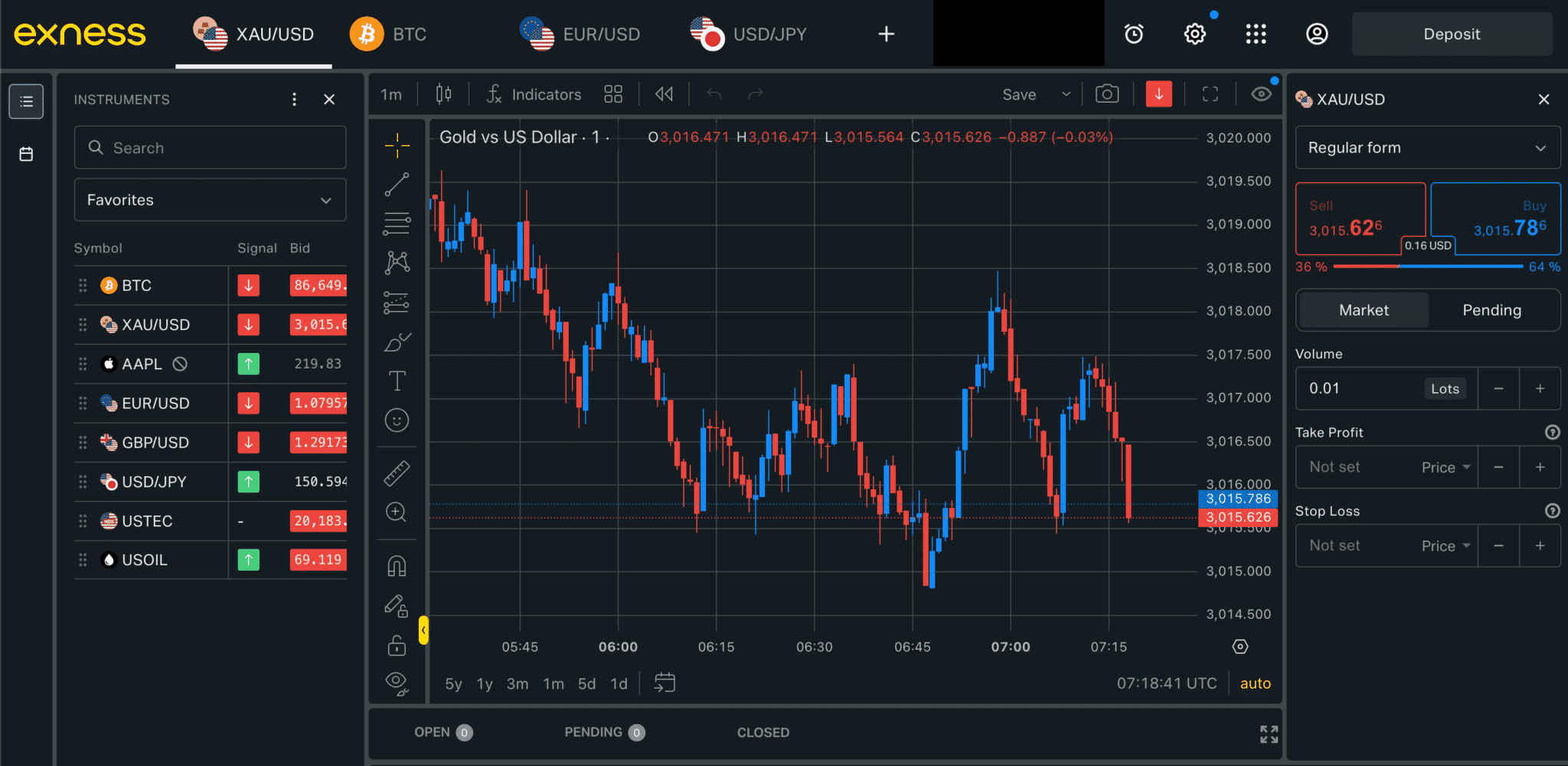

- Identical platform access and trade execution to standard accounts

- Transparent fee structure disclosed upfront

- May include a fixed admin fee that is not interest-based

Is Forex Trading Halal?

Forex trading is considered halal when it adheres to Islamic finance principles. Trading becomes haram if it involves interest, gambling, or unjust risk. A halal trading setup uses a swap-free account, operates transparently, and avoids speculation without analysis. Trading must involve clear contract terms and fair profit/loss sharing.

Islamic Finance Principles in Forex Trading

Understanding the key principles of Islamic finance helps explain why certain account conditions are required:

Riba (Interest): Riba means ‘interest’ and is prohibited. Traders cannot receive or pay interest on trades.

Gharar (Uncertainty): Excessive speculation or vague contracts are not permitted. Traders should make informed decisions based on analysis.

Maysir (Gambling): Trading must not involve random or chance-based outcomes. Strategy and risk management are essential.

Shared Risk: Shared risk means that when you trade using an Islamic account, you can make money or lose money based on how the market moves — no one promises a profit, and you take the risk yourself, which is fair and allowed in Islam.

Why Muslim Traders Use Islamic Accounts

Islamic accounts allow Muslim traders to access the global financial markets without compromising their religious beliefs. Standard accounts charge overnight interest (swaps), which is considered riba and is prohibited. Islamic accounts remove this, providing a structure that aligns with Shari’ah. They also support responsible risk-taking and ethical investing.

Features of a Compliant Islamic Account

No interest is charged or credited on overnight trades.

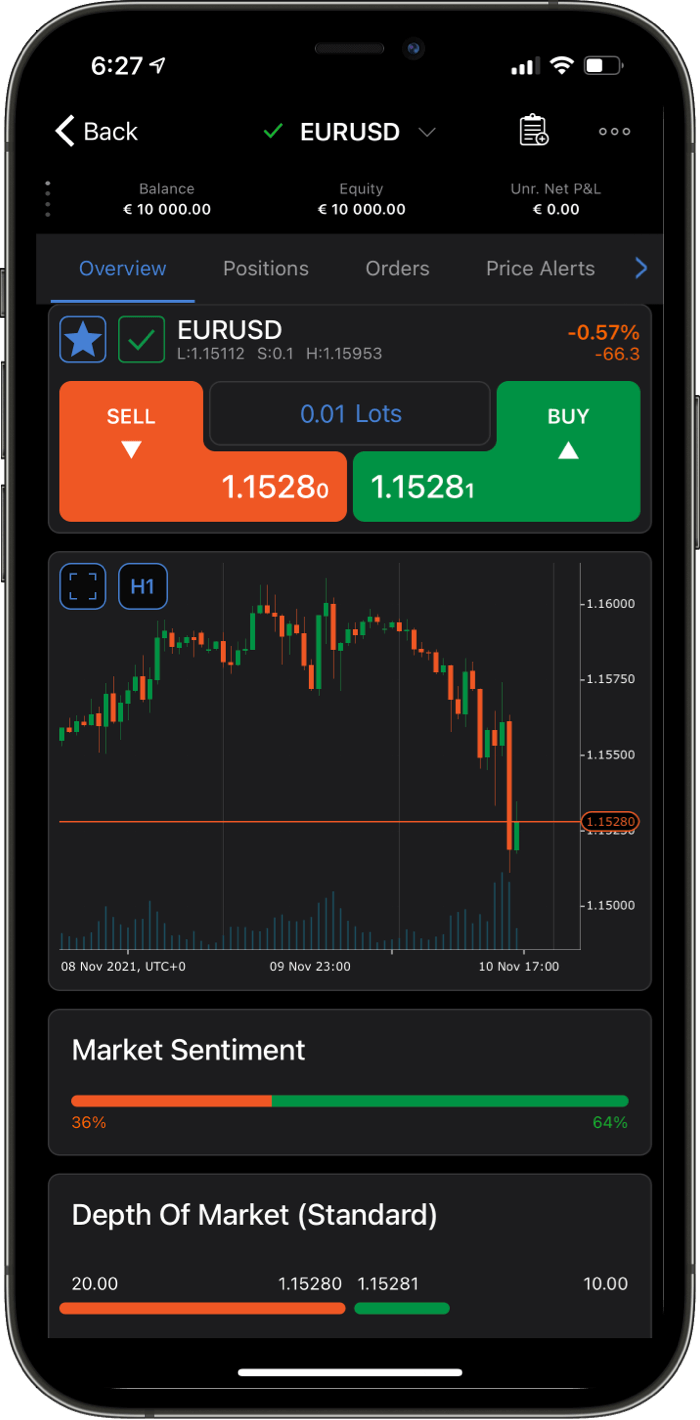

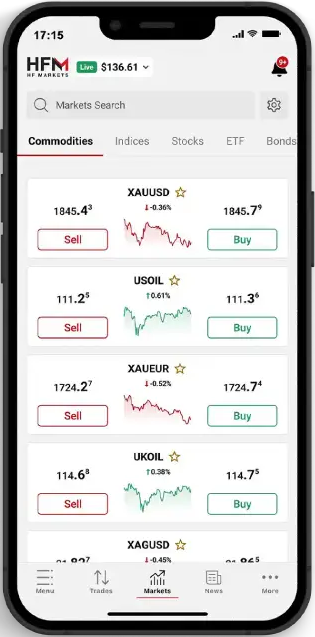

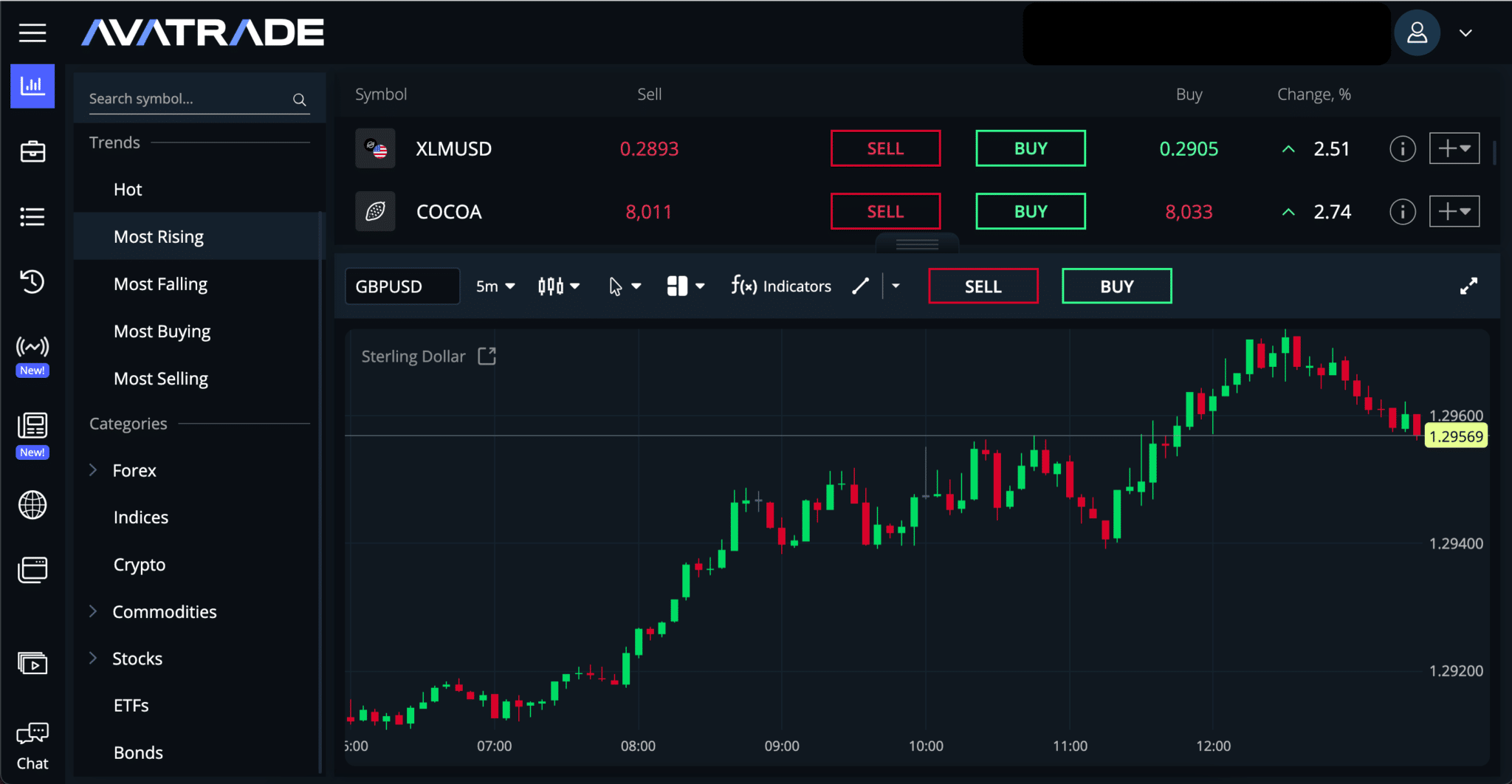

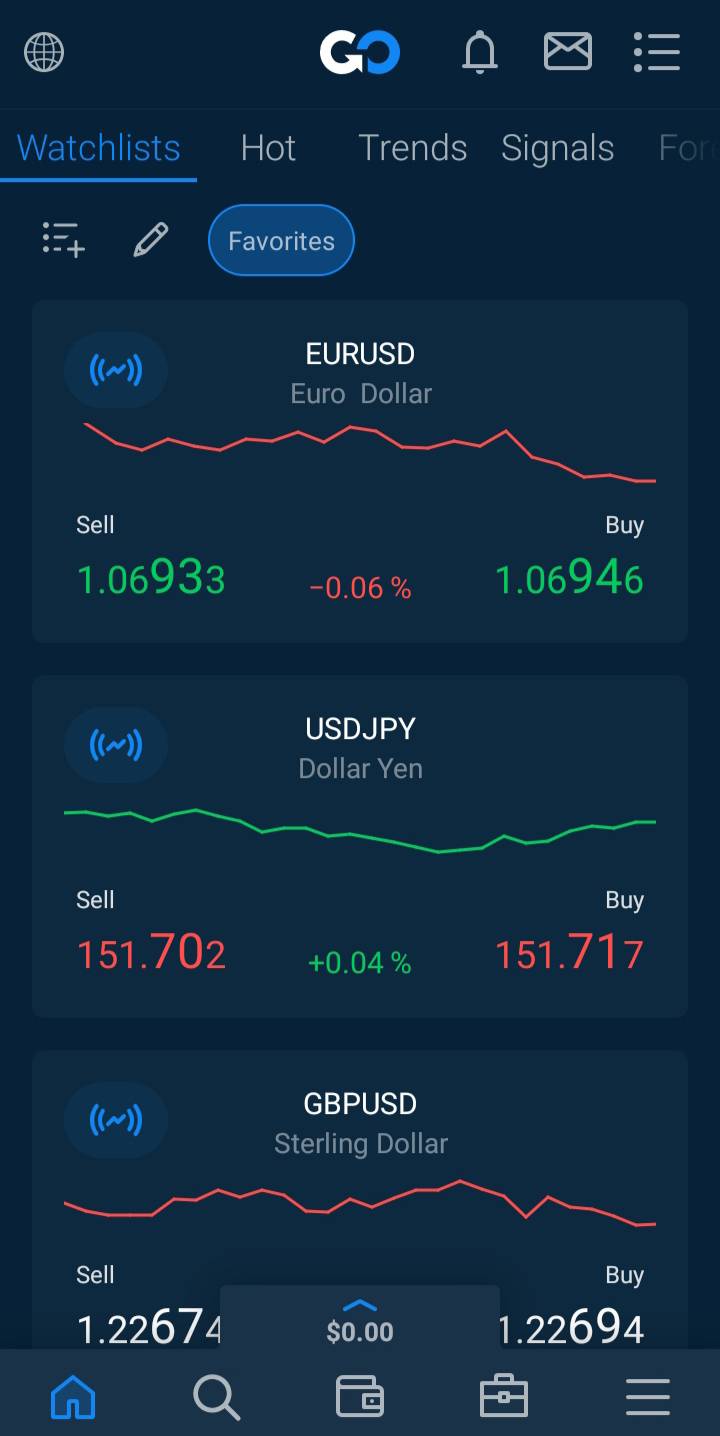

Islamic accounts should offer the same instruments, platforms, and execution conditions as regular accounts.

- Transparent Fee Structure

Some brokers charge an admin fee to offset the absence of swaps. This fee must be fixed, clearly disclosed, and unrelated to interest.

- No Restrictions on Strategy or Assets

A compliant Islamic account does not restrict access to specific instruments or trading styles unless this is clearly communicated.