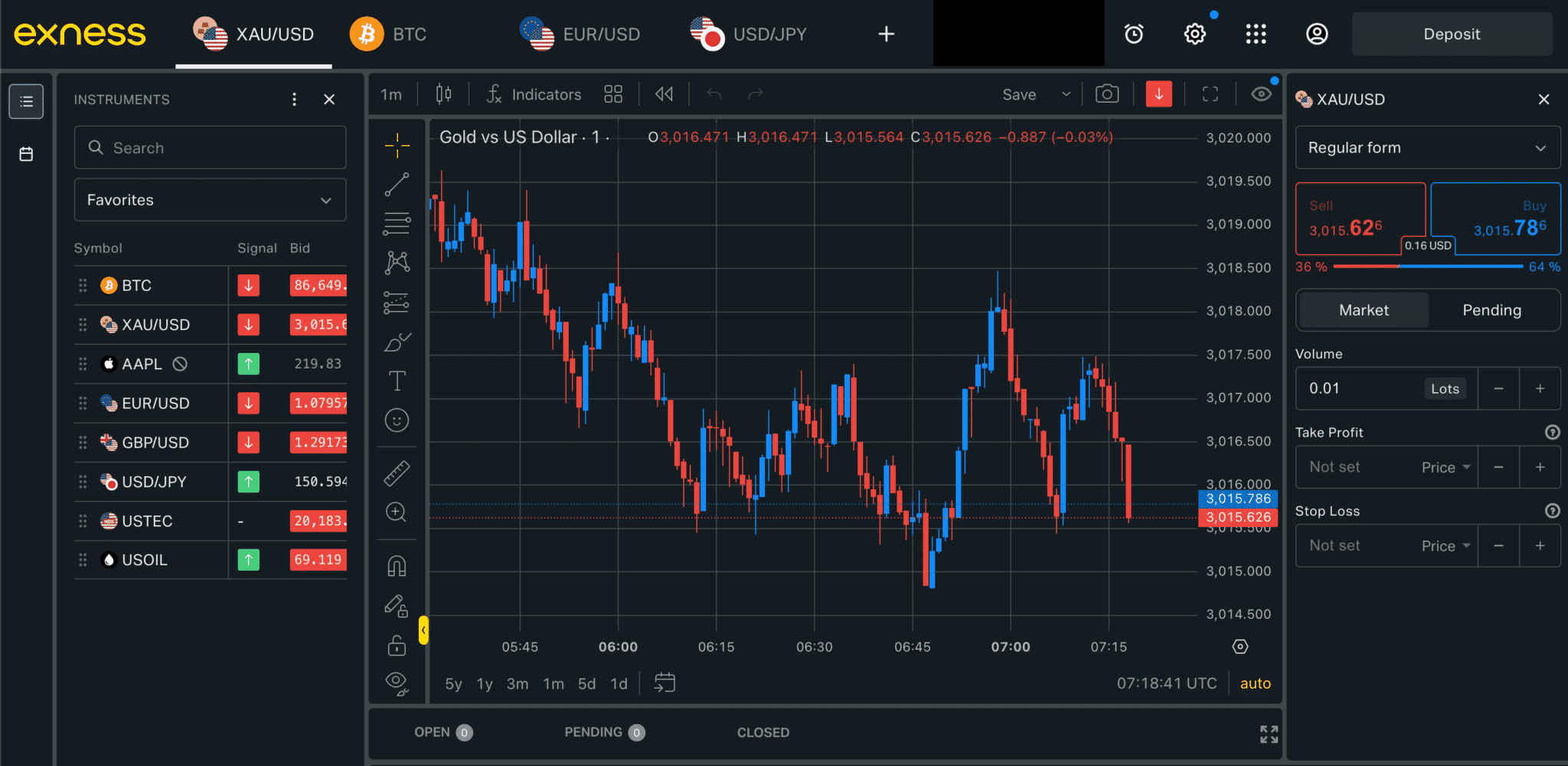

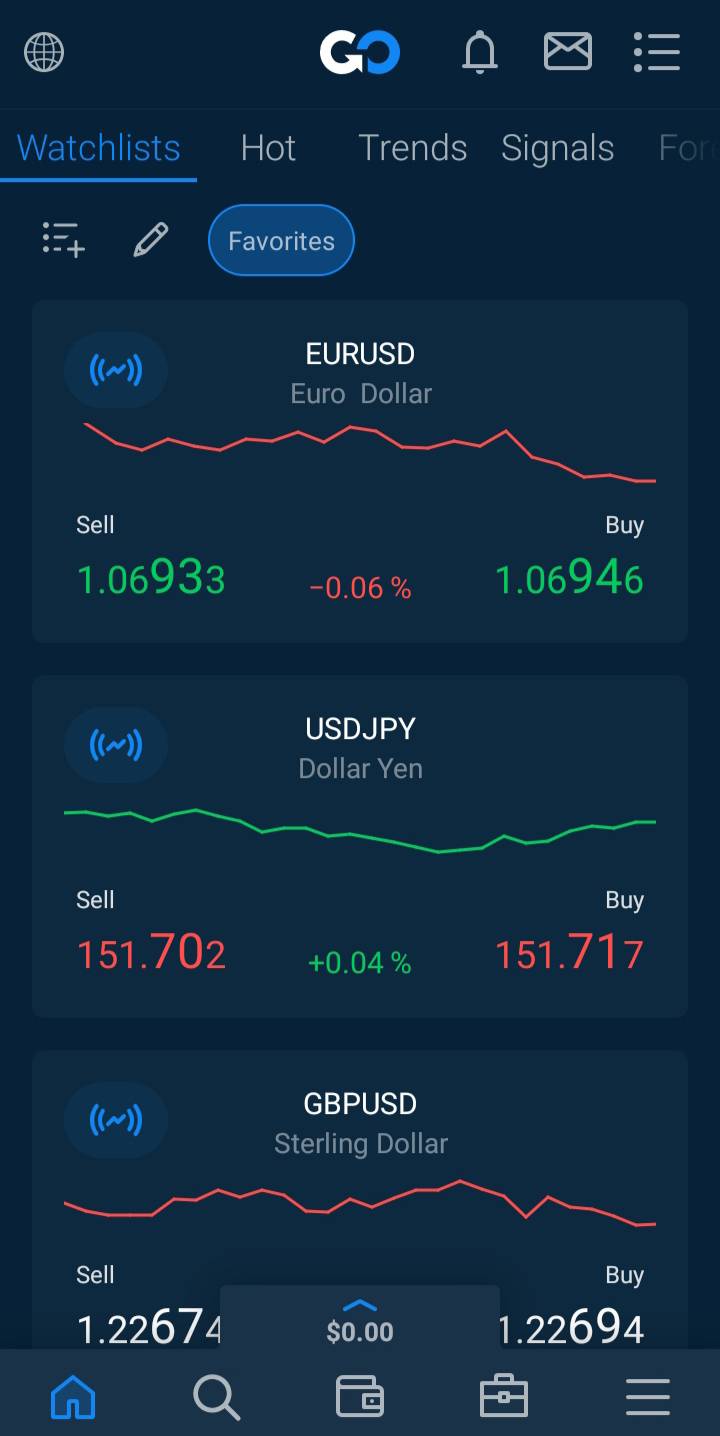

Leverage in Forex trading

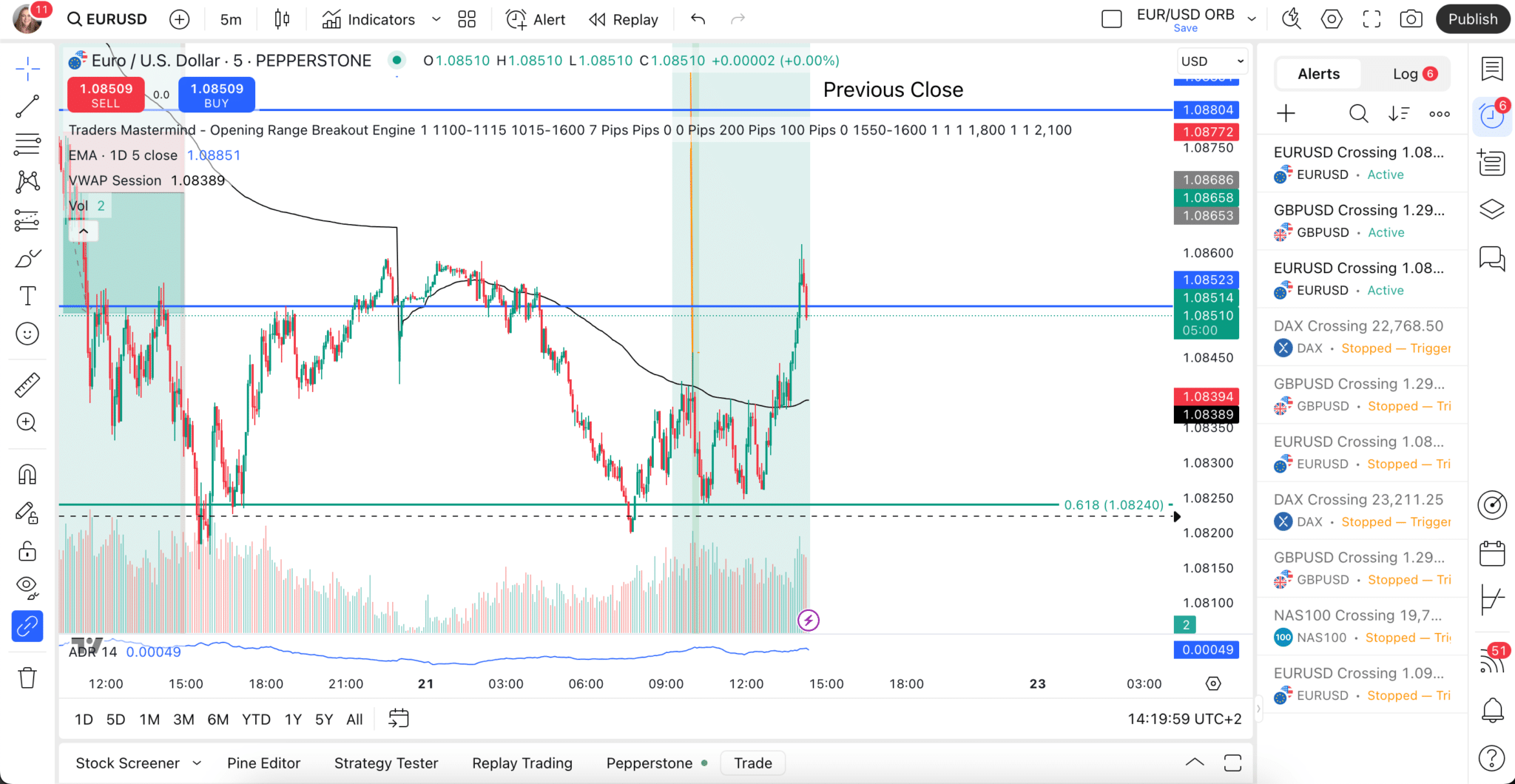

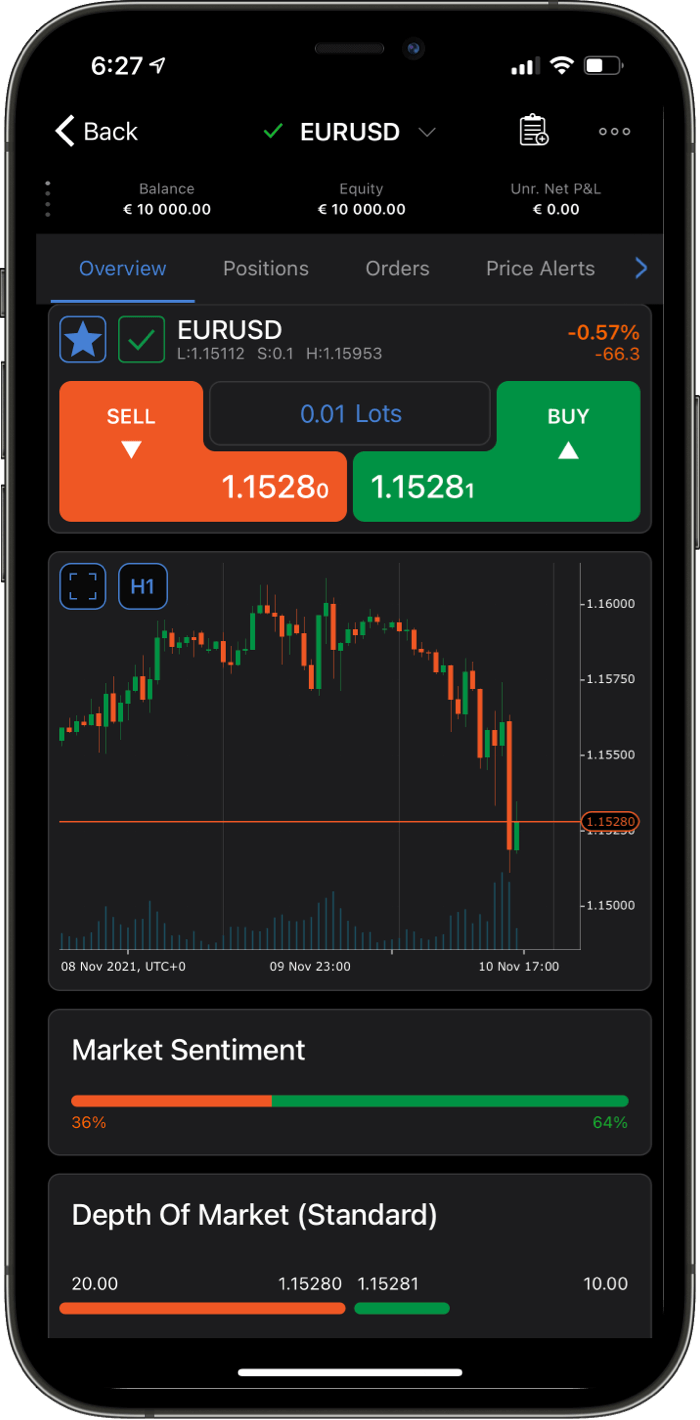

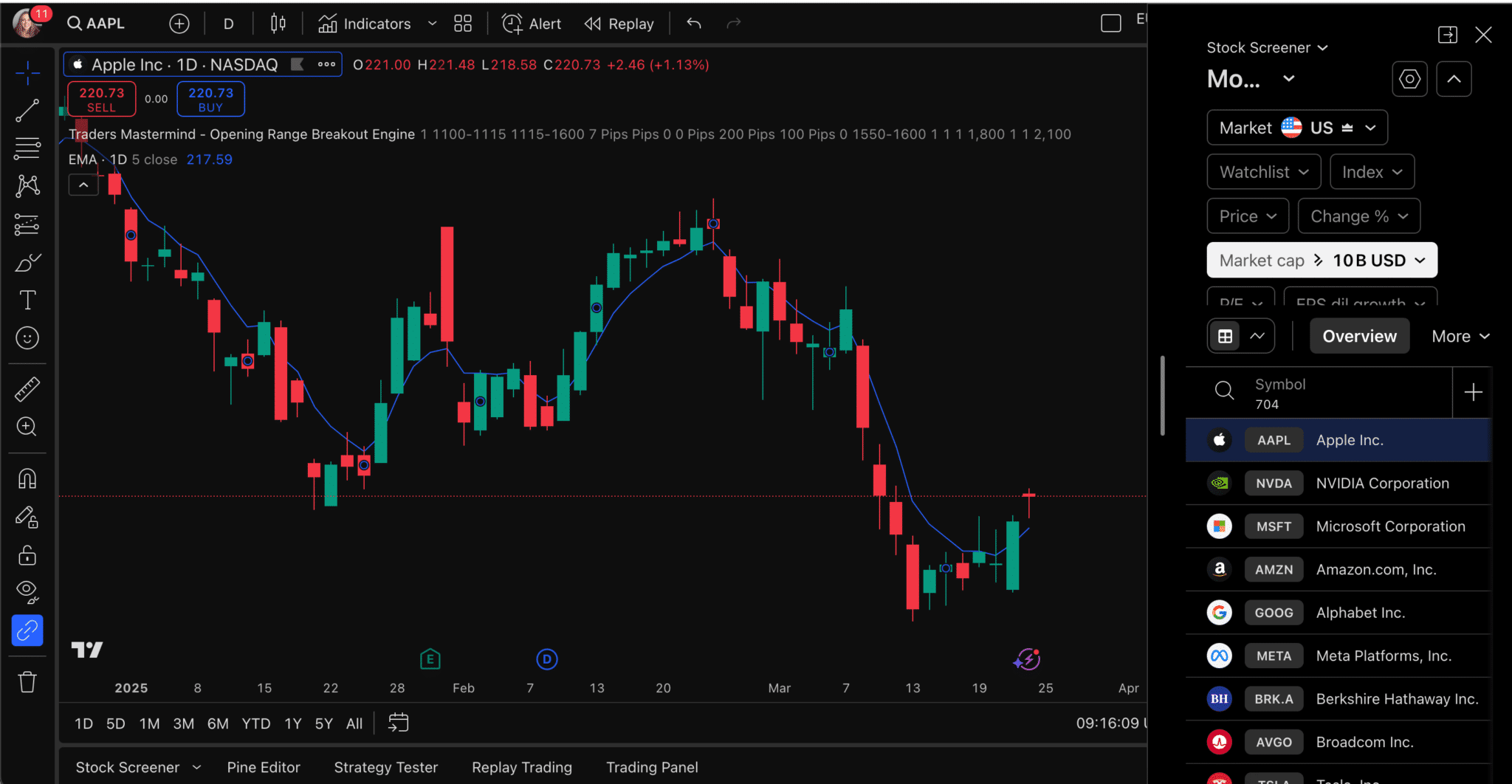

Leverage in Forex trading allows a trader to borrow funds from a broker in order to open positions larger than their account balance would otherwise allow. For example, a trader who deposits 10,000 USD and selects 100:1 leverage can open a position worth 1,000,000 USD. Only 1% of the position value is required as margin.

While leverage can dramatically increase profit potential, it also increases exposure to risk. A market movement of just 1% against a highly leveraged position could wipe out the entire margin. Losses are calculated on the full value of the position, not just the margin deposited.

Leverage regulation in Zambia

Unlike regulators such as the European Securities and Markets Authority (ESMA), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC), the Bank of Zambia (BoZ) does not currently impose a fixed leverage limit for retail Forex traders.

Zambian brokers are not legally required to cap leverage, although some may choose to set internal limits to protect clients. While traders may legally access leverage of up to 1:1000 or more with certain brokers, these brokers are expected to comply with Zambia’s financial regulations, including the Banking and Financial Services Act and the Securities Act, as overseen by the BoZ and the Securities and Exchange Commission (SEC) Zambia.

The BoZ’s supervisory focus includes:

- Conduct supervision and transparency

- Safeguarding and segregation of client funds

- Fair marketing of financial products

- Clear disclosure of trading risks, margin requirements, and potential losses

For more information, you can consult the Bank of Zambia’s and SEC Zambia’s official guidelines on Forex and leveraged trading.

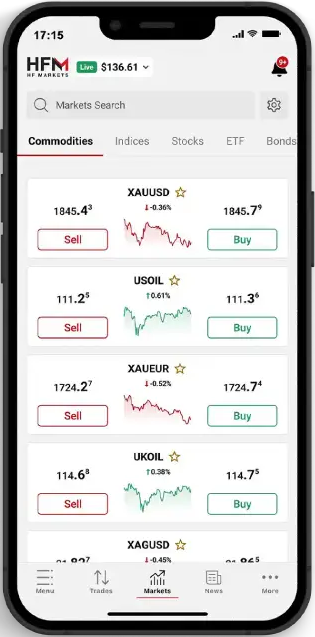

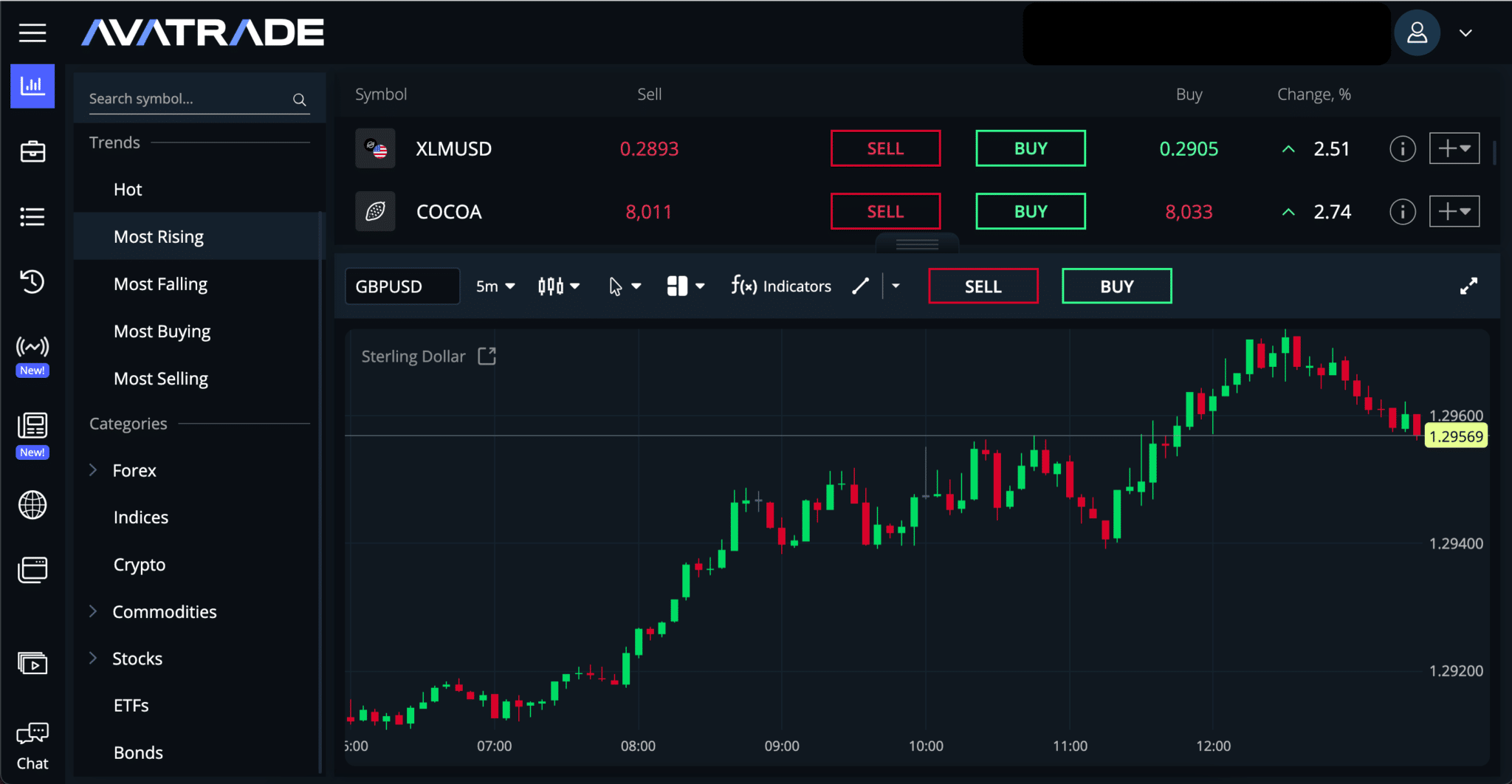

Offshore Brokers and High Leverage

Many Zambian traders turn to offshore brokers offering high leverage, sometimes as high as 1:3000. While this is legally permissible, it introduces additional risks.

Offshore brokers regulated by bodies like the Financial Services Authority of Seychelles (FSA), Belize’s IFSC, or St. Vincent and the Grenadines’ FSA are not subject to enforcement. If a dispute arises, clients may find it difficult or impossible to recover funds.