Is Forex Trading Legal in Zambia?

Yes, Forex trading is legal in Zambia, but it is not directly regulated for retail traders. The Securities and Exchange Commission (SEC) of Zambia oversees the capital markets but does not currently license local retail Forex brokers.

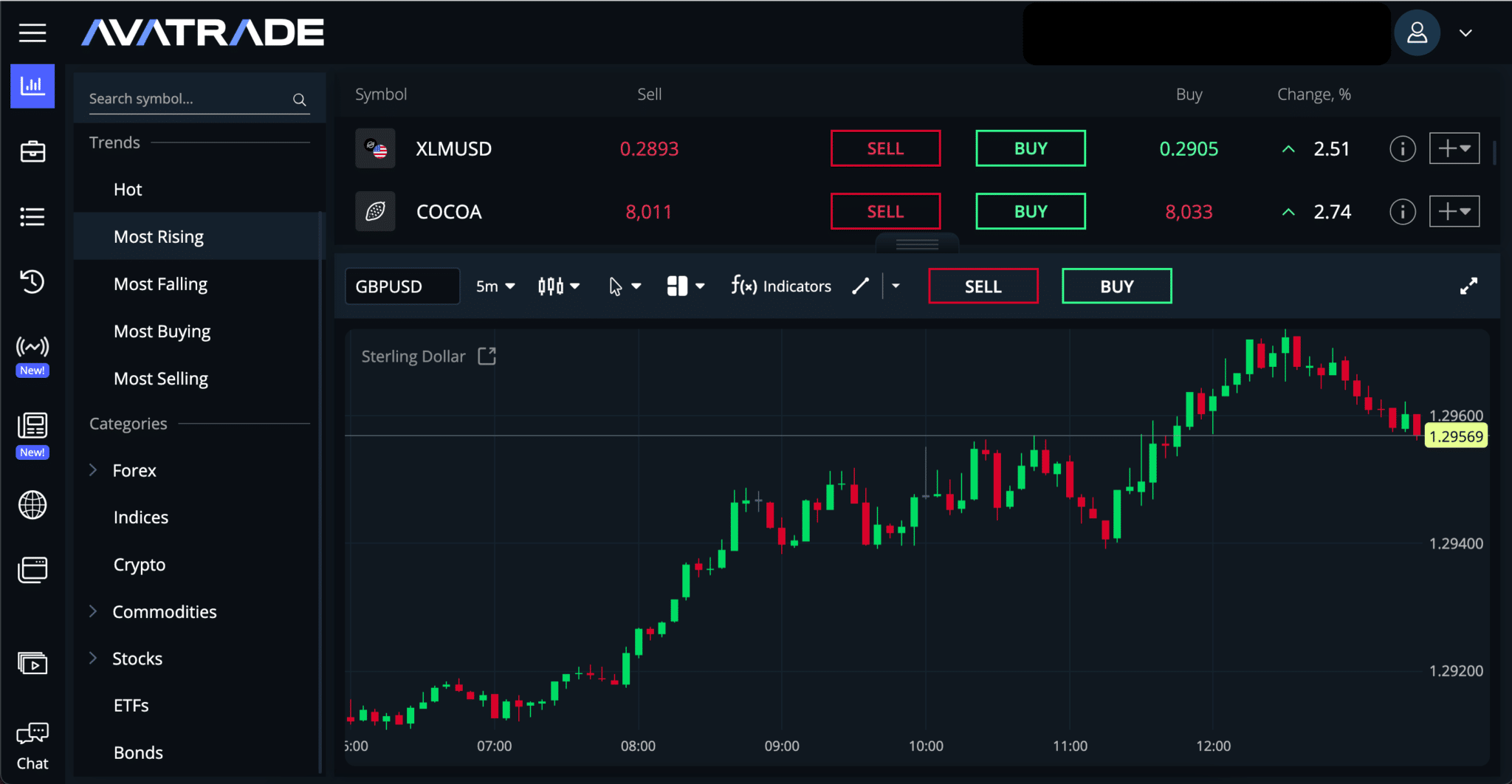

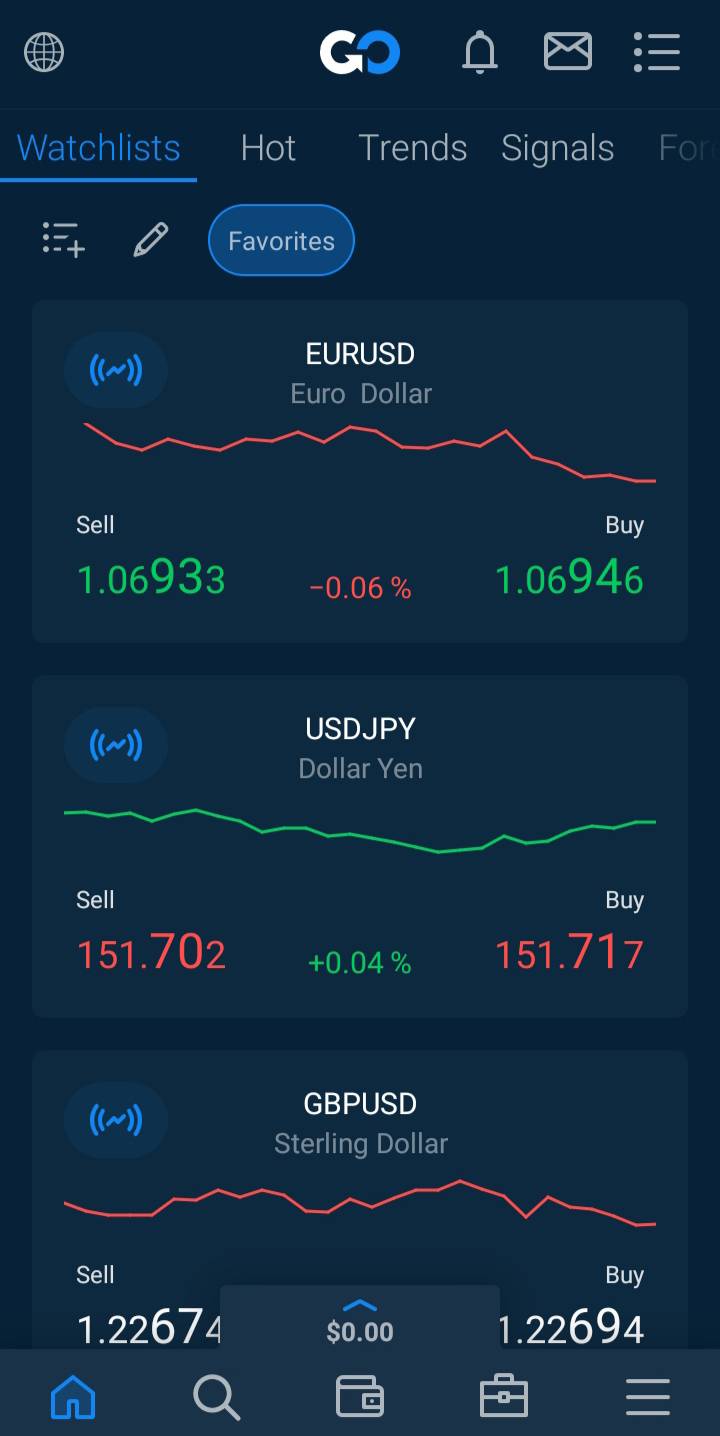

As a result, Zambian traders typically use international brokers regulated by tier-1 authorities like the FCA (UK), ASIC (Australia), or CySEC (Europe). Choosing a well-regulated broker helps ensure fund safety and fair trading conditions.

Traders in Zambia should also understand local tax obligations related to profits from Forex trading and comply with any currency regulations when funding and withdrawing from offshore brokers.

What Are the Advantages of Using a Regulated Broker?

Forex trading in Zambia is not regulated at the retail level, so using brokers licensed by authorities like the FCA, ASIC, or CySEC is essential for safety and transparency. Regulated brokers offer:

Client Fund Segregation: Client funds are held in separate accounts from broker operating funds for protection.

Financial Oversight and Licensing: Regulated brokers are required to:

- Maintain minimum capital

- Use risk management procedures

- File regular financial reports with their regulators

Transparent Fees and Risk Warnings: They must clearly disclose trading costs and risks such as spreads, commissions, leverage, and margin.

Standards of Conduct and Advertising: They are required to follow ethical advertising and fair client treatment practices.

Continuous Audits and Supervision:Regulated brokers undergo regular audits and inspections to ensure compliance.

Tip: Zambian traders should only use brokers regulated by top-tier authorities for safer Forex trading.

What are the risks of trading with an unregulated broker?

No fund protection: Unregulated brokers in Zambia do not separate your funds from operational funds, risking a total loss if they become insolvent.

No backup if things go wrong: Regulated brokers follow strict rules for client protection. Without regulation, there is no recourse or compensation if a broker shuts down.

You could lose more than you invested: Lack of negative balance protection can result in owing the broker money after sudden market moves.

They can get away with unfair practices: Unregulated brokers can manipulate trades, adjust prices, or deny withdrawals without accountability.

Dangerously high leverage: Extremely high leverage may result in large losses. Regulated brokers limit leverage to protect clients from excessive risk.

How Do I Verify if a Broker Is Regulated?

Retail Forex brokers are not locally regulated in Zambia, so traders should use international brokers regulated by reputable authorities.

Here’s how Zambian traders can verify a broker’s credentials before depositing funds:

- Look for the broker’s licensing statement at the bottom of their website. It should state:

“This website is operated by [Broker Name], authorised and regulated by [Regulatory Authority].”

- Go to the official regulator’s register:

- Search for the broker’s name.

If the broker appears, it is regulated. If not, it is not authorised.

Note: Regulated brokers must display their licence details clearly. If the licence is missing, the broker may not be authorised. Use the regulator’s contact details if you need confirmation.

Avoid scam websites:

- Use the broker’s official website link from the regulator’s register.

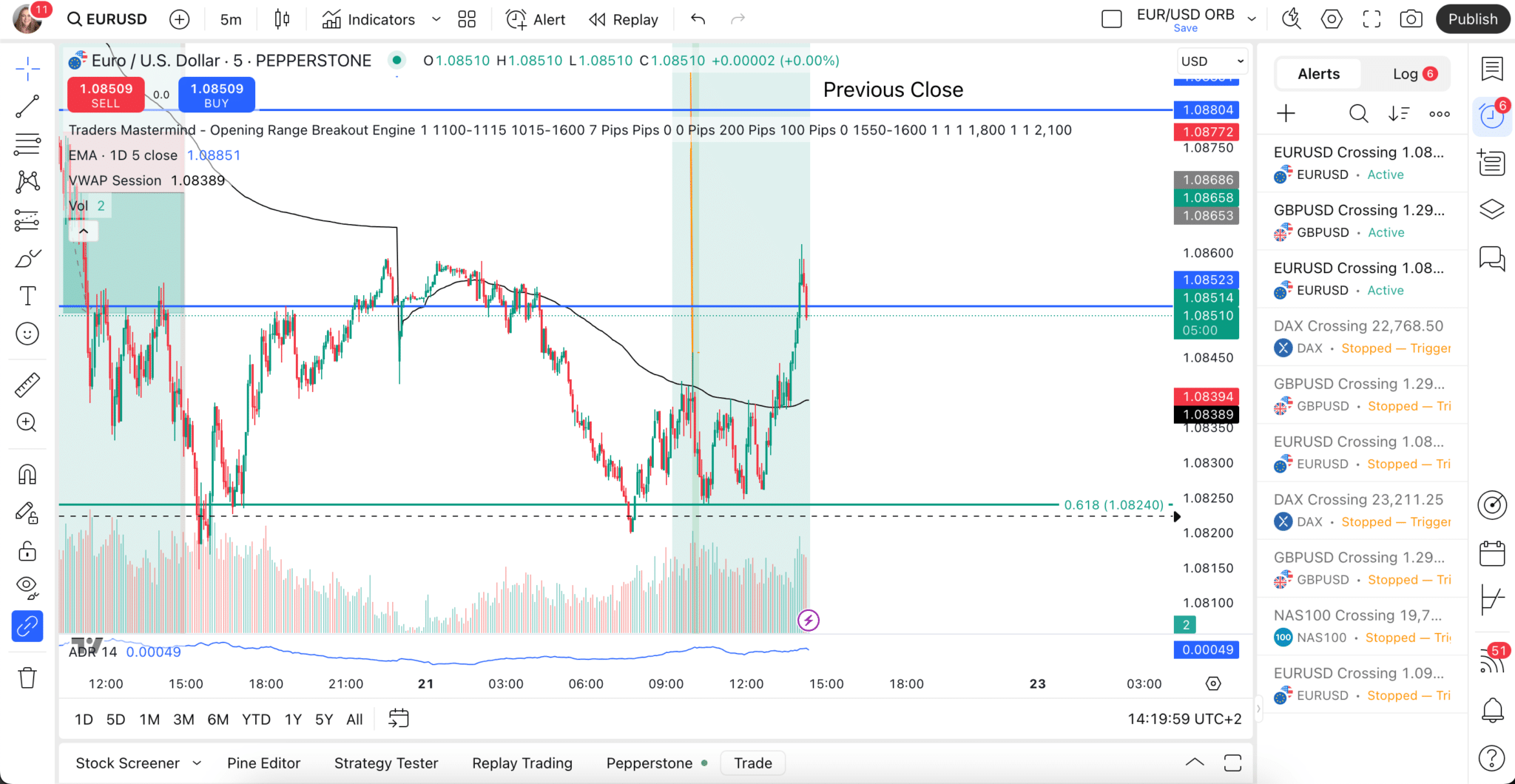

- Check URL spelling carefully (e.g., “pepperstone.com” vs. “pepperst0ne.com”).

- Confirm HTTPS encryption and SSL certificates in your browser.