What Are Crypto CFDs?

Cryptocurrency CFDs are a way to speculate on fluctuations in the cryptocurrency market without actually owning the coins themselves. When you trade contracts for difference (CFDs), you don’t purchase the underlying asset. Instead, you use market analysis to predict whether the price of a given financial instrument will rise or fall.

If you correctly predict the price movement, you will earn money, but if you get it wrong, you will lose money. When you buy and hold cryptocurrencies, on the other hand, you’ll use a digital wallet to create an account on a crypto exchange linked to a blockchain. From here, you’ll purchase or sell tokens using either fiat or digital currency. Buying and selling cryptocurrencies like this can be profitable, but you can only profit from rising market prices. CFDs give you a way to profit no matter which way the market is moving.

Is It Legal to Trade Crypto CFDs in Zambia?

Yes, CFD trading is legal in Zambia, but it is not directly regulated for retail traders. TheSecurities and Exchange Commission (SEC)of Zambiaoversees the capital markets but does not currently license local retail Forex brokers.

As a result, Zambian traders typically use international brokers regulated by tier-1 authorities like theFCA(UK),ASIC(Australia), orCySEC(Europe). Choosing a well-regulated broker helps ensure fund safety and fair trading conditions.

Where Can You Buy and Sell Cryptocurrencies?

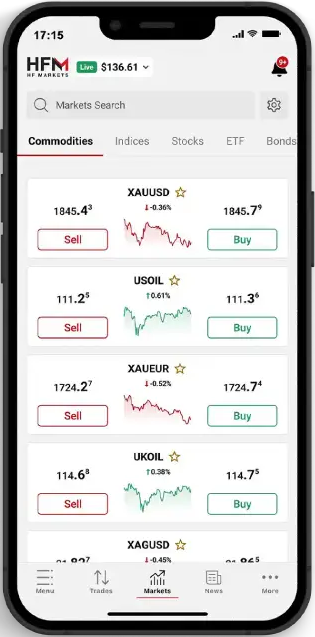

There are multiple ways to access the cryptocurrency market:

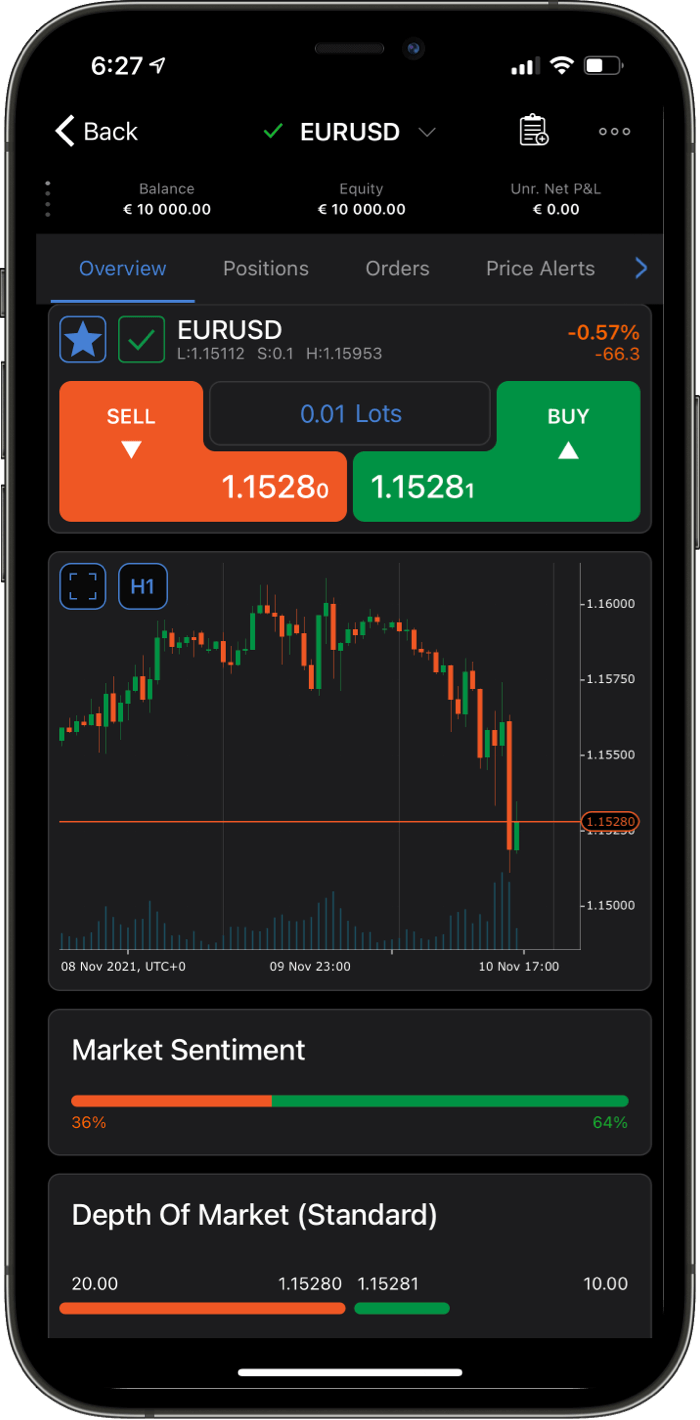

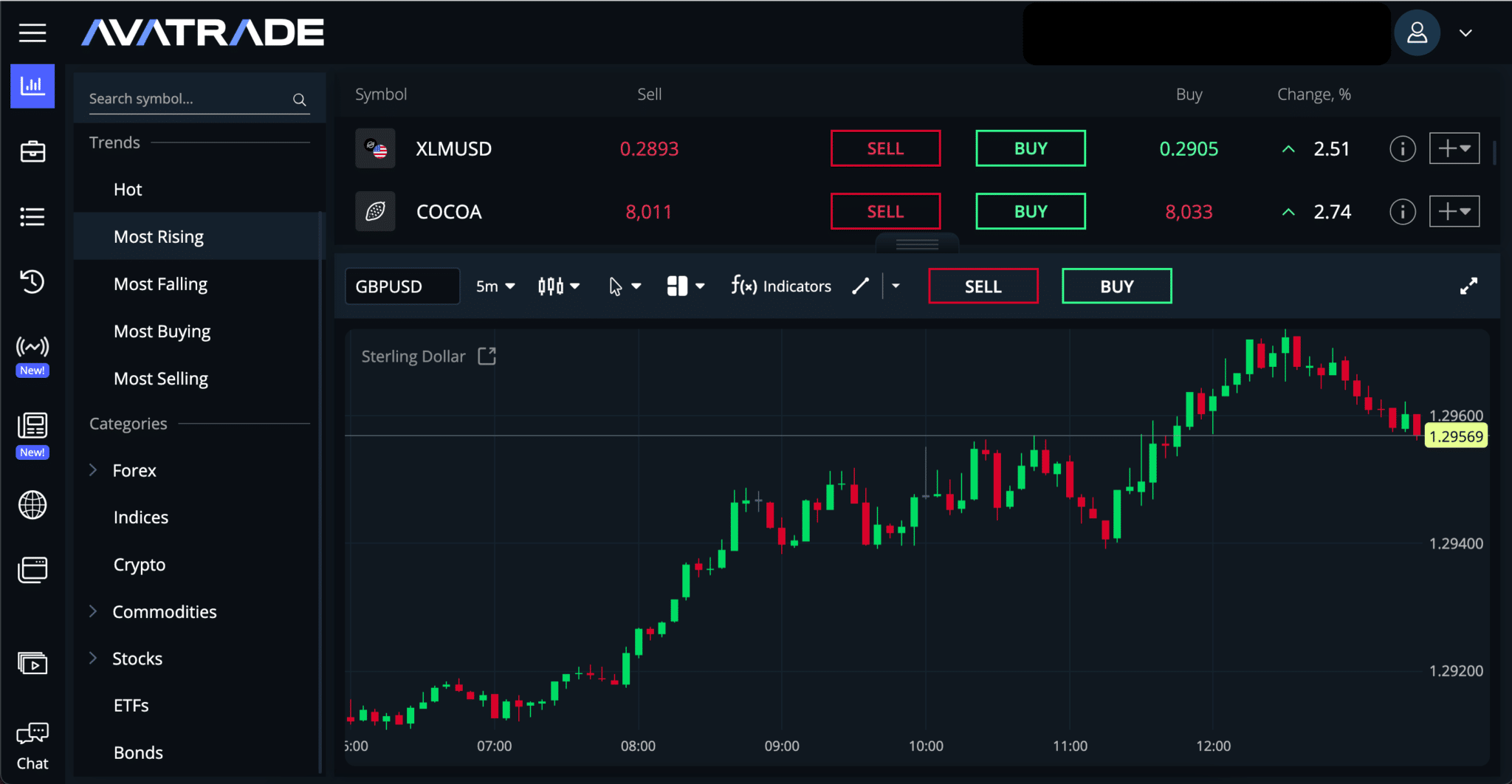

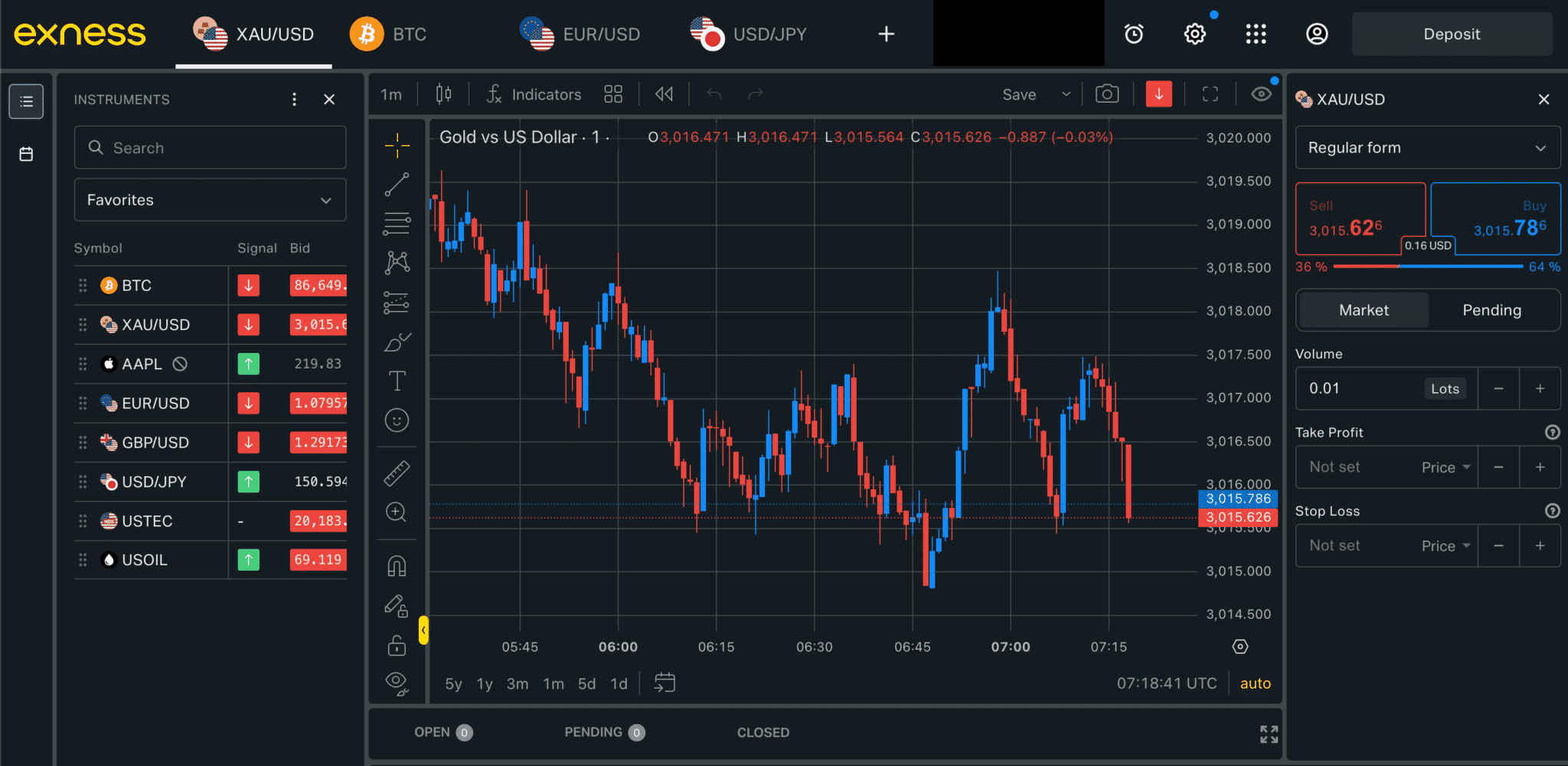

- Through well-regulated brokers: This is the simplest and safest method. Brokers like AvaTrade allow you to speculate on crypto CFDs with leverage, and oversight from trusted regulators.

- Through centralised exchanges: Platforms like Binance, Kraken, and Coinbase offer a wide selection of tokens. However, they require a wallet, and most do not offer leverage.

- Peer-to-Peer (P2P) platforms: These allow direct trades with other crypto holders. While sometimes cheaper, liquidity is lower, and scams are more common.

For most Zambian traders, a regulated broker offers the best combination of safety, convenience, and trading flexibility.

How do you trade crypto CFDs?

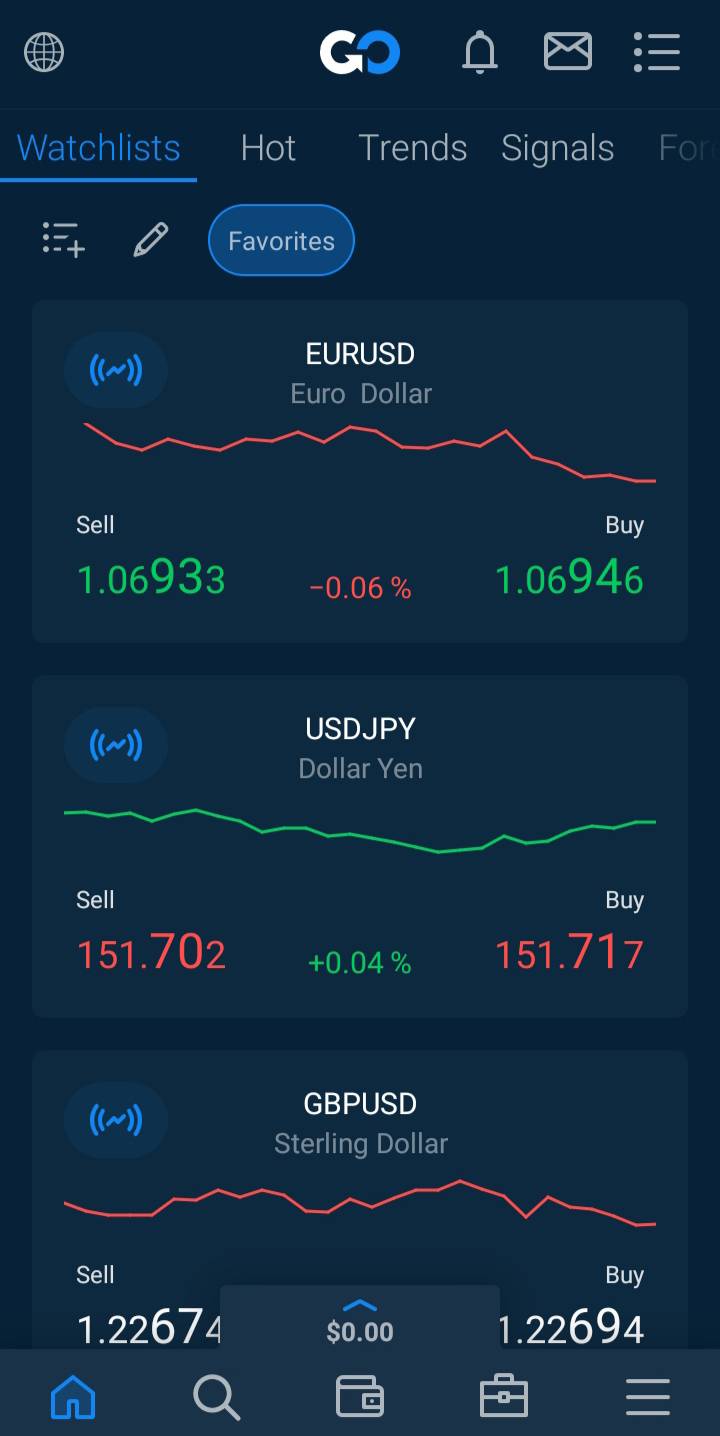

Just as when you trade any other currency, you trade cryptos in pairs, either against fiat currencies such as the US dollar or against another crypto. For example, you could trade Bitcoin against the euro (BTC/EUR) or against Ethereum (BTC/ETH). The US dollar is by far the most traded fiat currency globally, and BTC/USD (where BTC is the base currency) is the most popular crypto-to-fiat pair. For example, when the price of the BTC/USD pair is 100,000, it takes US$100,000 to buy one Bitcoin.

The advantage of trading cryptocurrencies against major currencies like the dollar or the euro is that these are relatively liquid markets, making it reasonably easy to find a buyer and a seller for your trade. This, in turn, means that such markets are less volatile than other pairings (such as crypto-to-crypto pairs) and the spreads tend to be narrower.