Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Ralph Nelson Elliott, the man behind the Elliott Wave Theory, discovered that crowd behaviour trends in recognisable patterns. In his research, Elliot found similar recurring patterns regardless of the financial market and time frame. This research would eventually lead him to develop the Elliott Wave Principle. At the core of this principle, Elliott noted thirteen distinct market patterns or waves that periodically repeat in both shape and form.

The main take away from the Elliott Wave Principle is that the financial markets are fractal and we see the same patterns repeating on lower time-scales (lesser degree). Since trading using Elliott Waves is an advanced and more complex trading method, it is perhaps best to introduce the core principles and patterns outlined in this theory.

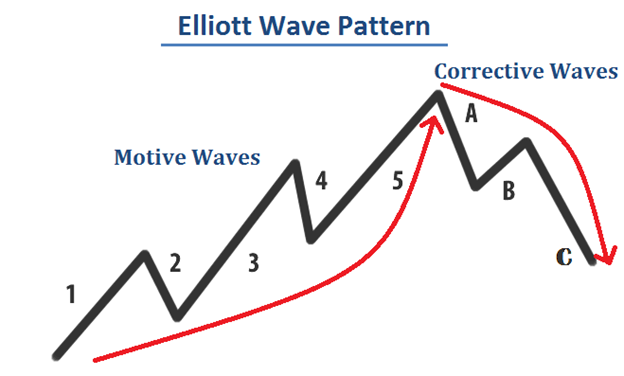

In the theoretically perfect world, Elliott Waves occur in sets of five sub-waves - three up and two down (see Figure 1). After the 5th wave, the trend reverses and corrects the prevailing trend in three large corrective waves. The market doesn’t move linearly and the purpose of having a 5-wave move is to allow for variations.

In Elliott Wave Theory, there are two main sub-types of waves in the Elliott Wave Pattern:

Each the Motive waves (1, 3 and 5) are in the direction of the trend, and the declining Corrective waves (2 & 4) are smaller than the motive waves and go against the prevailing trend. If you see this pattern play out in full, it serves to reinforce the idea that we’re moving in a trend and points to the direction of the trend.

Figure 1: Elliott Wave Count

A genuine Elliott Wave (EW) pattern must satisfy three essential rules for the five-wave move to be confirmed (Source):

These rules ensure that there is progress in a trend, which makes for a more detailed version of Dow Theory that the market moves in several big swings. Other guidelines to keep in mind are as follows:

Unlike Motive waves, Corrective waves sub-divide into three sub-waves, with the primary objective or correcting the Motive waves. Corrective waves are labelled using letters rather than numbers to distinguish the three different types of corrective wave structures.

A flat Elliot Wave pattern is made up of three waves A, B and C of higher degree that follows a 3-3-5 wave structure, meaning that wave A subdivides into 3 waves, wave B into 3 waves and wave C into 5. There are three different types of flat EW patterns: Regular, Irregular and Expanded or Running flat.

The Zigzag Elliott Wave pattern is made up of three waves A, B and C that follow a 5-3-5 wave structure, meaning wave A subdivides into 5 waves, wave B into 3 waves and wave C into 5. Zigzags have a sharp look and usually occur in wave 2 of an impulsive wave.

The Triangles Elliott Wave pattern is made up of five waves A, B, C, D, E of higher degree, that follows a 3-3-3-3-3 wave structure. All five waves are subdivided into 3 sub-waves. There are three different types of triangle patterns: Contracting, Barrier and Expanding.

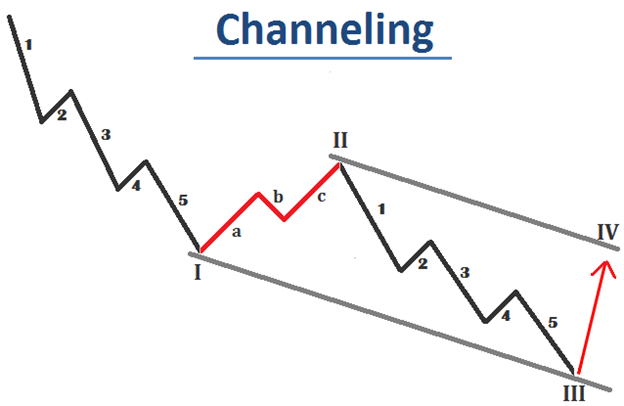

A useful strategy for trading using the Elliot Wave Patterns is called Channeling. Draw a I-III channel line connecting the peaks of wave I and III, to identify the bottom of the IV (fourth) wave by extending that line from the II wave. As the Elliott wave principle states that following the 5 waves, there will be 3 corrective waves; a trader can establish directional bias, and place take-profit orders accordingly.

Figure 2: Elliott Wave Channeling

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.