What is TradingView?

Founded in 2011 by Denis Globa, Constantin Ivanov, and Stan Bokov, TradingView began as a charting application with built-in social features, allowing traders to share insights and learn from one another.

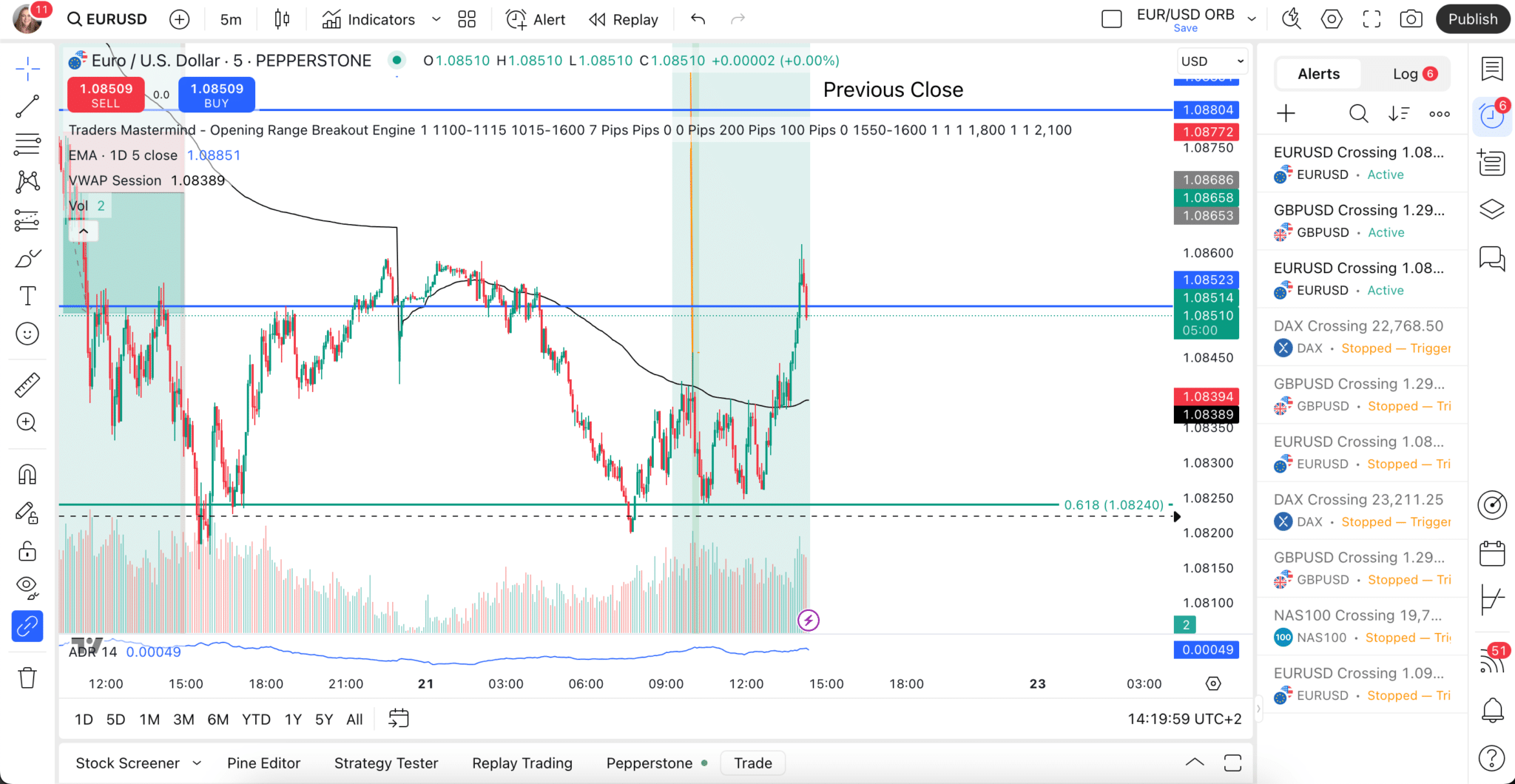

Today, it is a full-featured, cloud-based platform used for charting, strategy testing, and trading across multiple financial markets — including forex, stocks, crypto, and indices.

TradingView’s evolution and current offerings

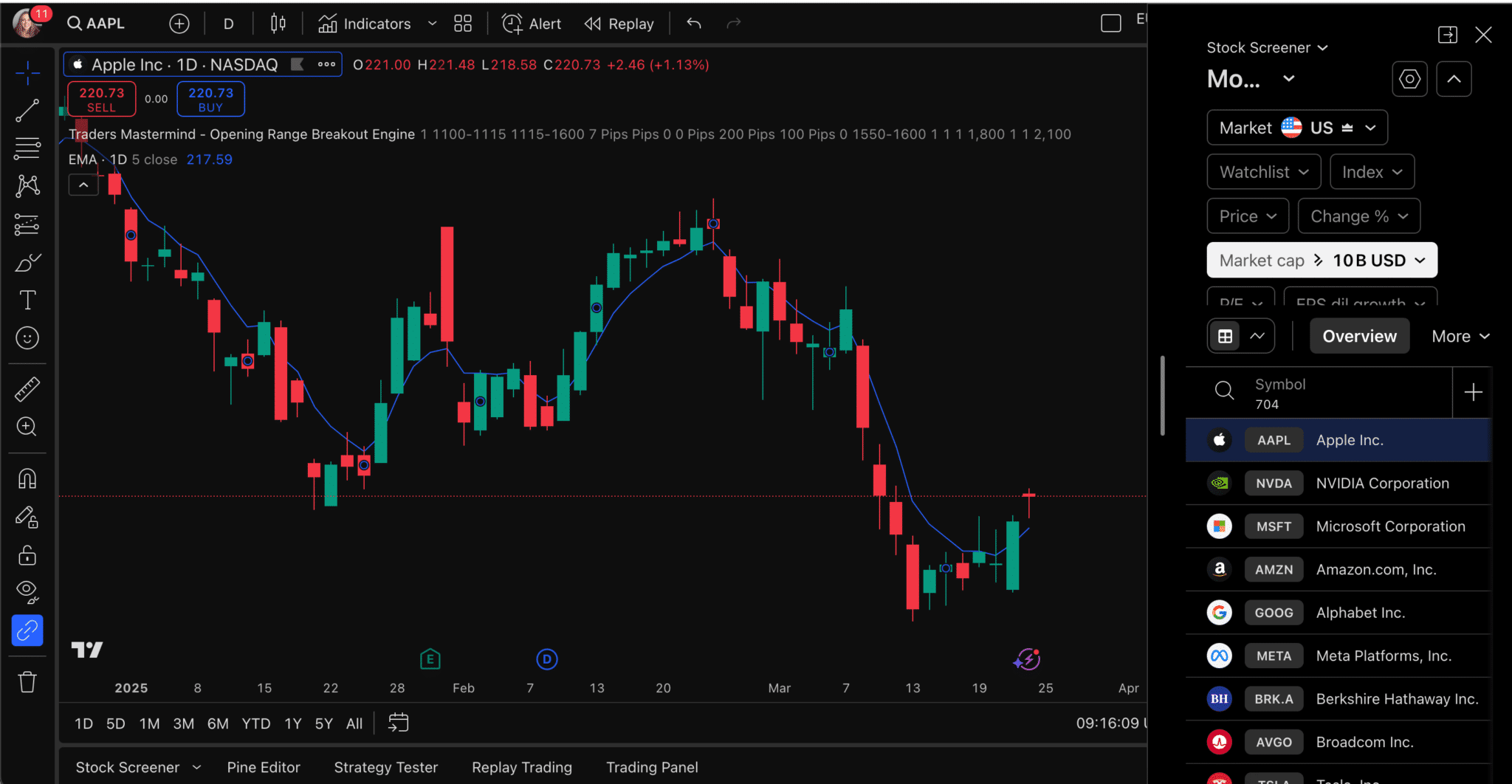

Powerful charting tools:

TradingView’s charts are among the best in the industry — fast, customisable, and equipped with hundreds of indicators, timeframes, and templates.

Comprehensive analysis features:

Traders can access both technical and fundamental data, overlay multiple instruments, and build custom scripts or indicators using Pine Script.

Community interaction:

TradingView is also a social network for traders. Users can publish trade ideas, follow others, ask questions, and collaborate. This community aspect makes TradingView unique among charting platforms.

Multi-asset tracking and trading:

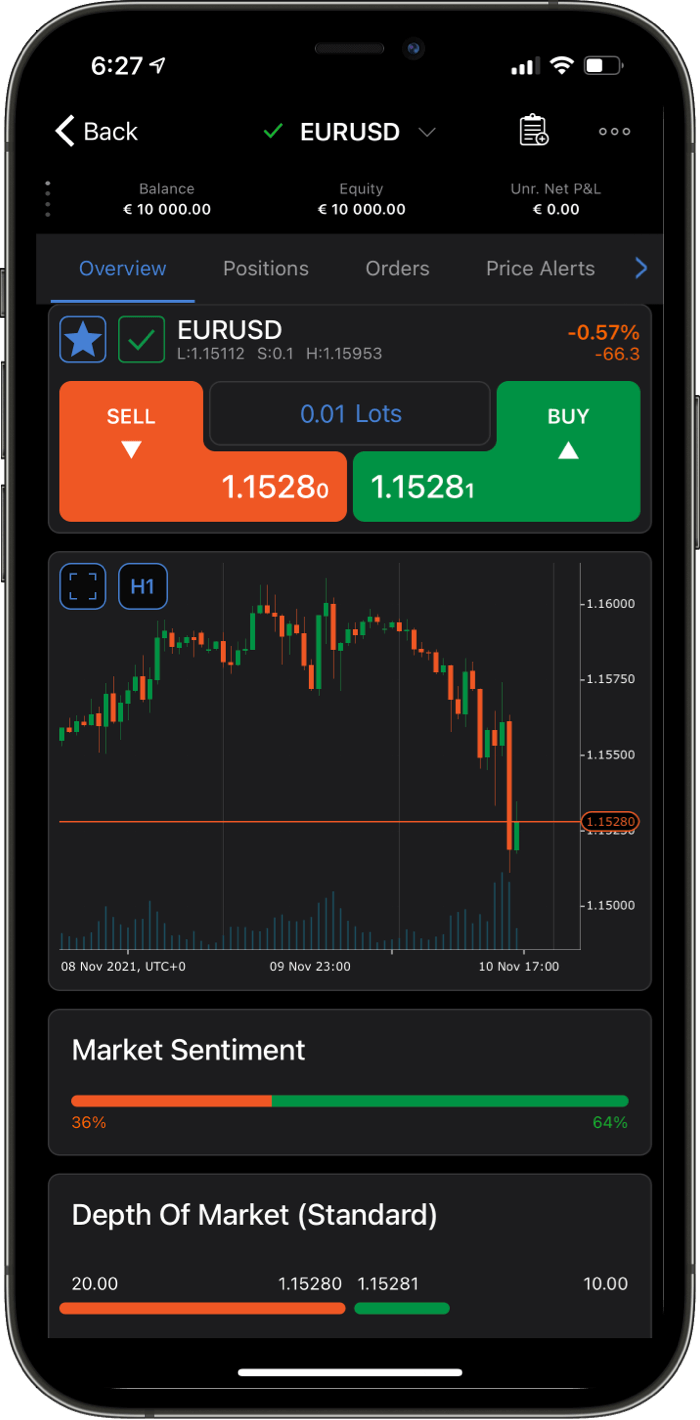

Beyond charting, users can analyse and trade forex, shares, crypto, and other derivatives. Once connected to a supported broker, they can execute trades directly from TradingView charts.

Cross-platform accessibility:

TradingView runs smoothly on web browsers, desktop software, and mobile apps, providing traders with complete flexibility across devices.

Custom alerts and automation:

Users can create real-time alerts based on price, volume, or indicator conditions, making it easier to react quickly to market moves.

Expanding broker support:

Each year, more brokers integrate with TradingView — reflecting the platform’s growing popularity among retail traders.

How to use TradingView

- Choose a compatible broker from our list above and open an account.

- Connect your TradingView profile to the broker using the Trading Panel.

- Analyse the markets using TradingView’s tools, indicators, and chart layouts.

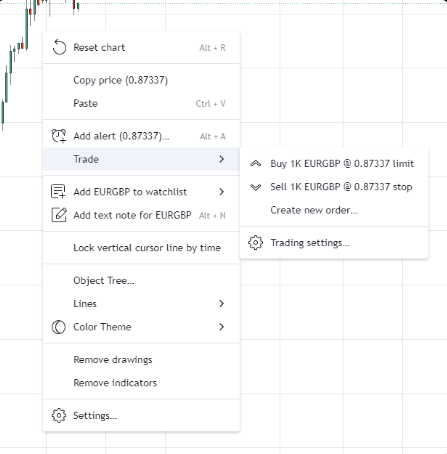

- Place a trade:

- Under the chart title, click the blue (Buy) or red (Sell) button.

- Adjust trade size, order type, take-profit, and stop-loss levels.

- Confirm and execute directly on the chart — your broker processes the trade.

Trading hours and available markets depend on your broker’s offerings and the instruments you trade.

TradingView’s pricing plans

TradingView offers a range of options — from a free Basic plan to several paid tiers (Pro, Pro+, and Premium) designed for active and professional traders.

- The free version offers robust functionality for beginners, although it has limitations on alerts, indicators, and chart layouts.

- The premium plans remove these limits, unlock more indicators, provide advanced chart types, and allow multiple chart templates.

- In our experience, the Basic plan suits most casual traders, but frequent or professional traders benefit from the paid tiers’ expanded toolset and improved performance.

For a full breakdown of features and pricing, visit TradingView’s official website to compare plans.

Benefits of using TradingView

- Extensive analytical tools: A huge library of technical indicators and drawing instruments for every trading style.

- Real-time data and news feeds: Great for combining technical and fundamental analysis.

- Instrument comparison: Easily compare multiple symbols on one chart to spot correlations and patterns.

- Vibrant community: Learn from other traders, discuss strategies, and share your own setups.

- Cross-device access: Trade and analyse seamlessly on desktop, tablet, or mobile.

Drawbacks of using TradingView

While TradingView outperforms many competitors in functionality and usability, there are a few limitations to consider:

- Limited broker integration: Only certain brokers connect directly to TradingView for live trading.

- Advanced features require a paid plan: The free version has ads and limits on alerts and layouts.

- Steep learning curve: With so many tools, beginners can feel overwhelmed at first.

- Community-generated scripts: Not all custom indicators are verified or high quality.

- Performance slowdown: Complex strategies or heavy data use can cause lag on older devices.

TradingView vs Autochartist

Although both TradingView and Autochartist offer charting and analytical tools, they serve different purposes.

Autochartist is an automated pattern-recognition plugin most commonly bundled with a broker’s platform. It scans markets and highlights trade setups, but it’s purely analytical — trades must still be placed manually via your broker’s platform.

TradingView, by contrast, is a complete trading environment. You can chart, analyse, and execute trades directlythrough the platform, provided your broker supports TradingView integration.

Key advantages of TradingView over Autochartist:

-

Direct trade execution – Open and close trades straight from the chart.

-

Active trader community – Share ideas, follow other traders, and interact in real time.

-

Extensive customisation – Build, publish, or tweak your own indicators using Pine Script.

While Autochartist remains a strong supplemental tool, TradingView combines analysis and execution — making it a more powerful and versatile platform for active traders.