Here’s how to get started with paper trading on TradingView:

- Create or Log In to Your TradingView Account: You need a TradingView account to use the paper trading feature. If you don’t have one, sign up for free on their website. If you have signed up with a broker, you can open a TradingView paper trading account through their portal.

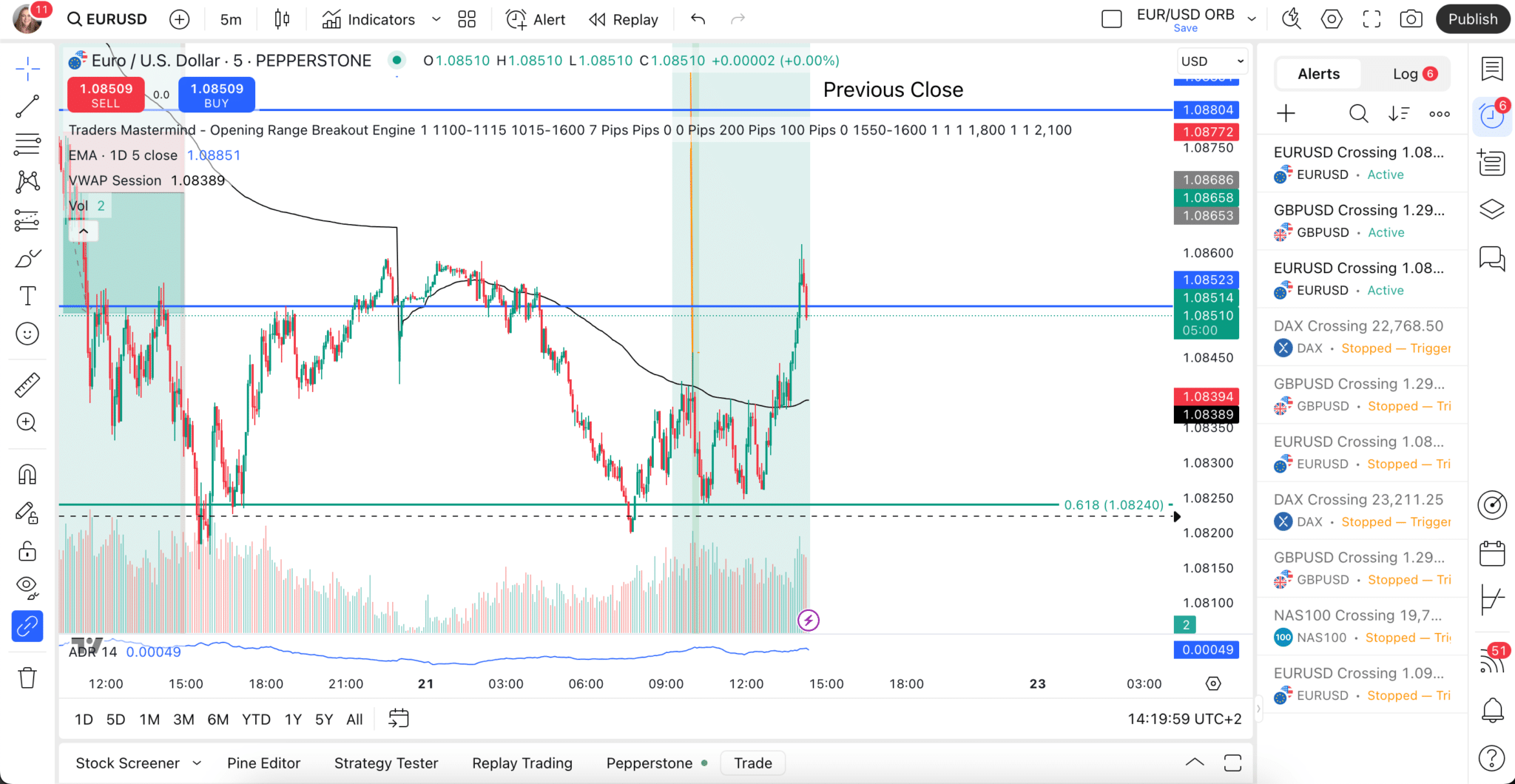

- Access the Trading Panel: Once you have logged in, you will find the trading panel at the bottom of the screen. This panel is where you’ll manage your trades.

- Select the Paper Trading Account: If you haven’t signed up with a broker, you will select ‘Paper Trading’ from the list of available brokers. This will activate the paper trading mode.

- Set Up Your Virtual Account: When you first start paper trading, TradingView provides you with a default virtual account balance (the amount can vary, e.g., $100,000 in virtual funds). You can reset this amount and change the settings, such as leverage, etc., to suit your trading strategy.

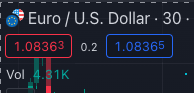

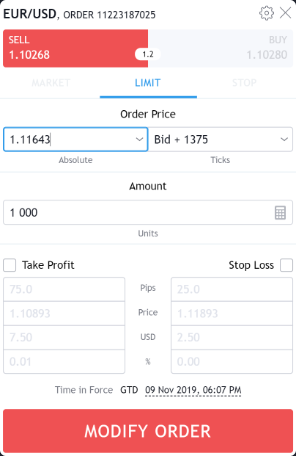

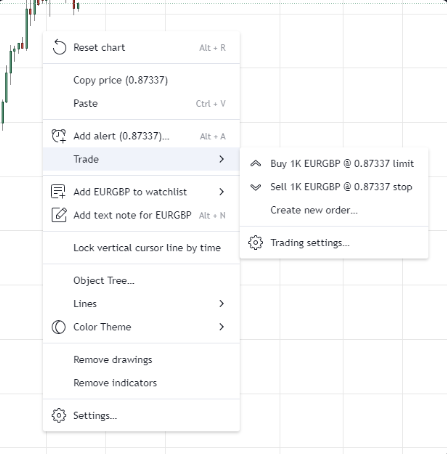

- Start Trading: Use the charting tools and analysis features of TradingView to identify trading opportunities. When you’re ready to place a trade, click the ‘Buy’ or ‘Sell’ button on the chart or in the trading panel. Here, you will determine your position size and take-profit and stop-loss levels.

- Manage Your Trades: Monitor open positions, adjust stop-loss and take-profit orders, and close trades as necessary, all within the trading panel.

- Review Your Performance: Regularly check your trading performance. TradingView provides tools to analyse your paper trading history, helping you learn from both successful and unsuccessful trades.

- Experiment and Learn: Use paper trading as a learning tool. Experiment with different strategies, indicators, and asset classes without the risk of real trading.

Remember, while paper trading on TradingView simulates actual market conditions, there are differences in emotion, psychology, and market dynamics when trading with real money. Paper trading is an excellent educational tool, but it’s essential to understand these differences before transitioning to live trading.

What are the main benefits of using TradingView compared to other trading platforms?

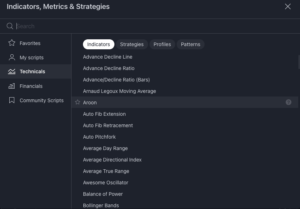

- A broad selection of analytical tools: It offers a comprehensive set of technical analysis tools, encompassing many different indicators, drawing instruments, and charting choices, all of which are customisable.

- Tools for fundamental analysis: TradingView provides real-time data feeds and news updates to help traders make well-informed decisions.

- Easy instrument comparison: Traders can effortlessly compare various instruments on a single chart. This function allows users to spot correlations, trends, and patterns among multiple assets, helping them develop more effective trading strategies.

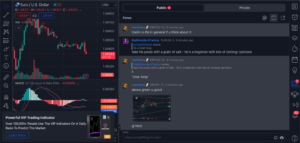

- Community Driven: Traders can benefit from the collective knowledge of a large trading community.

Are there any cons to using TradingView?

While TradingView has outdone its competitors on many fronts, including its functionality and features, we have found a few drawbacks to using the platform:

- Limited Broker Integration: TradingView does not integrate with many brokers. This limits some users’ ability to execute trades directly from the platform. However, you can choose a broker from the list above, all of which are highly rated.

- Basic Features Require Subscription: Many of TradingView’s more advanced features are not available in the free version. Access to these features requires a paid subscription, which may not be ideal for all traders, especially those just starting out.

- Overwhelming for Beginners: TradingView’s extensive range of tools and data can be overwhelming for beginners. The platform has a steep learning curve, and navigating the myriad features and options can be challenging for new users.

- Reliance on Community Scripts: Many of the indicators and tools available on TradingView are community-generated. While this can be a strength, it also means the quality and reliability of these tools can vary significantly.

- Performance Issues with Complex Analysis: Users conducting complex or data-intensive analyses might experience performance issues, such as slower loading times or lag, especially on less powerful computers.

FAQs

How do you backtest on TradingView?

Backtesting is a way to test if a trading strategy or setup would have made money in the past. A trader needs to backtest a strategy to determine if it’s likely to be profitable and worth the effort.

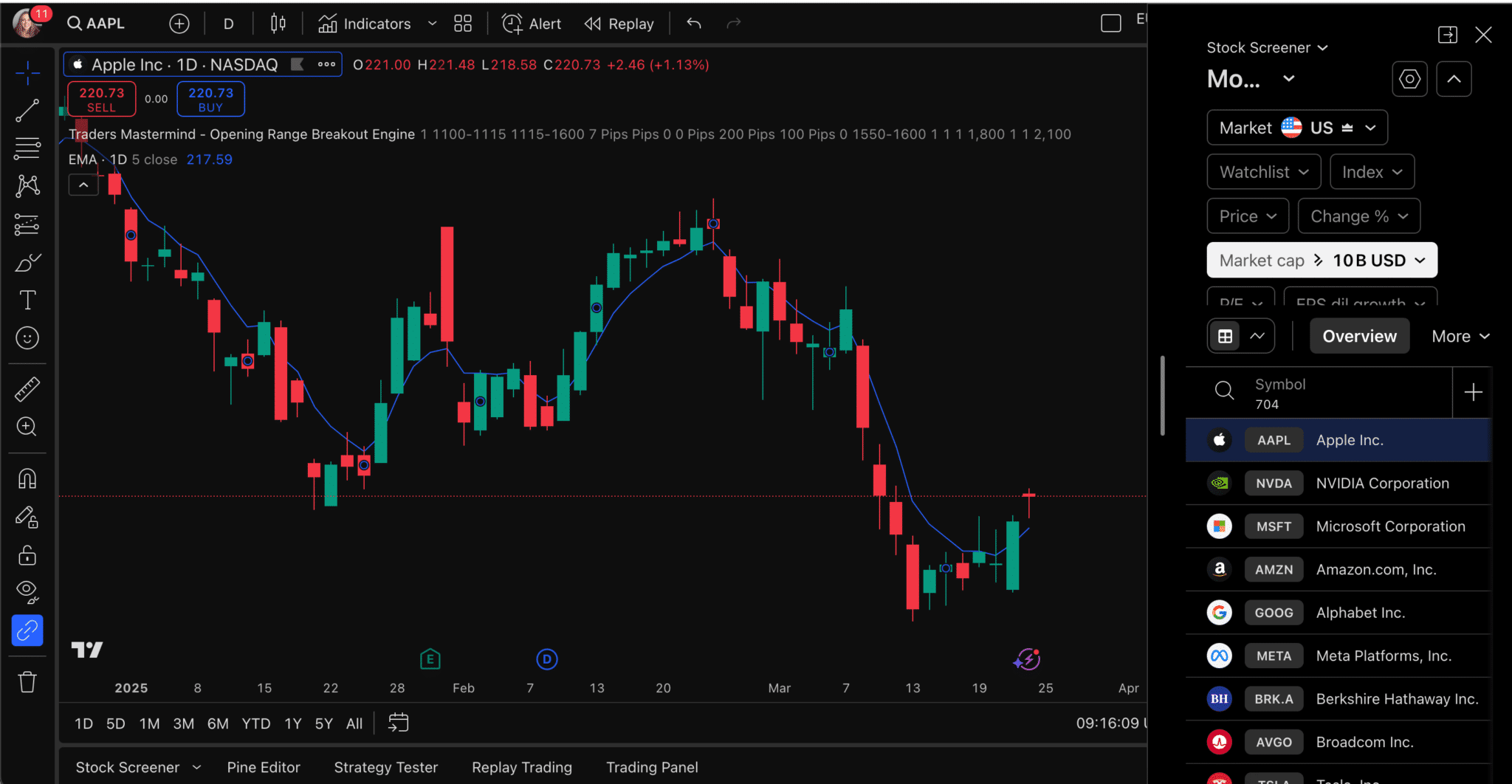

TradingView offers a very effective backtesting functionality. You can use its Strategy Tester tab to backtest strategies based on indicators.

This tool shows you how the strategy would have worked in the past. You can use the rewind tool to go back in time and look for trades from a year, month or week back. It also gives you a performance summary and details of each trade. There are 23 built-in strategies, and you can also make your own or use others shared by the TradingView community.

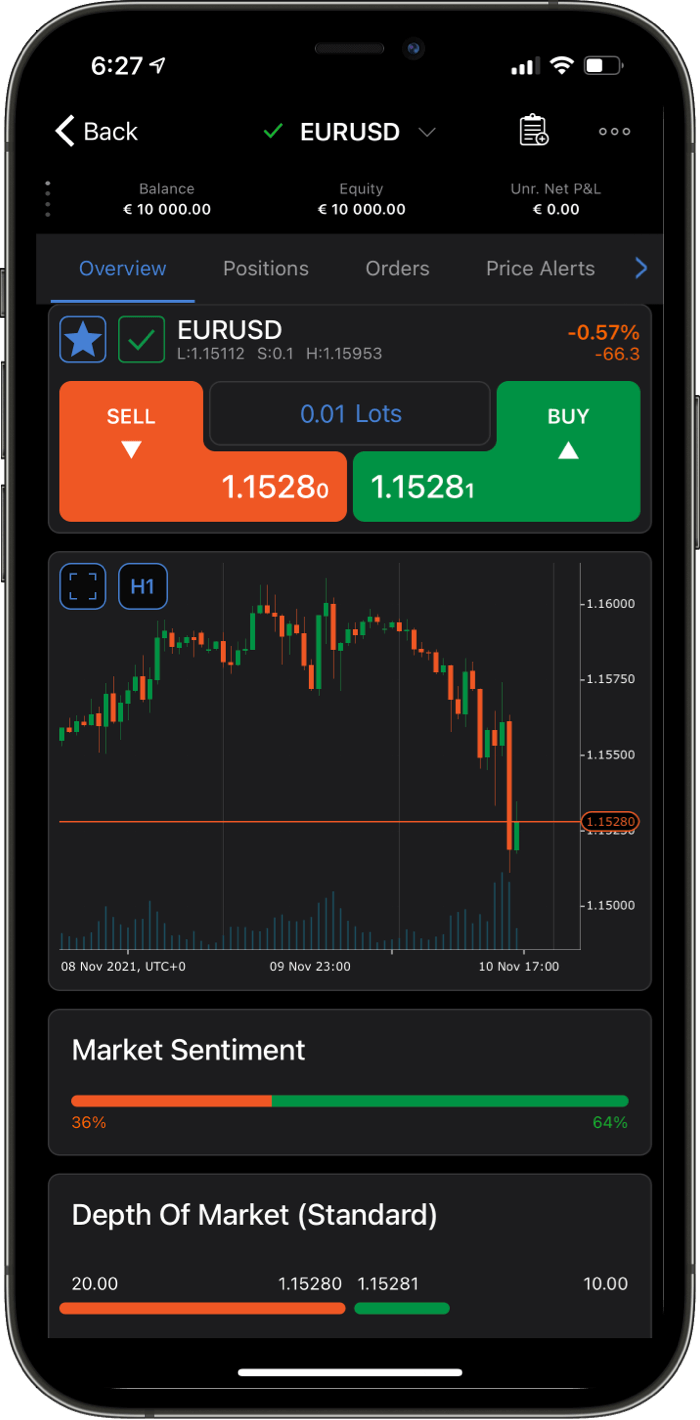

Can I access TradingView on mobile devices?

Yes, TradingView is available on both Android and iOS through its mobile app. The mobile TradingView app allows traders to monitor their trades, view charts, and perform analysis while on the go.

Where can I find tutorials and educational resources about using TradingView?

TradingView provides an extensive Help Center on its website, featuring tutorials, guides, and FAQs to help users navigate the platform efficiently. The TradingView community forum and blog also serve as valuable resources for information and perspectives shared by fellow traders.

How do I make TradingView dark?

You can choose whether to have light or dark charts and interfaces. To turn on the dark theme, click on your name at the top left corner of the chart. A drop-down menu will appear. The 5th item down on the menu says, “Dark Mode.” Click on this toggle, and the interface will go dark.

TradingView vs Autochartist

Traders can access TradingView independently of a broker by taking out a subscription. The cost ranges from free to US$59.95 per month. Other charting and analytical tools such as Trading Central and Autochartist can only be accessed via a broker’s platform. However, once you’ve joined the broker, you can then access the services provided by Trading Central and Autochartist for free.

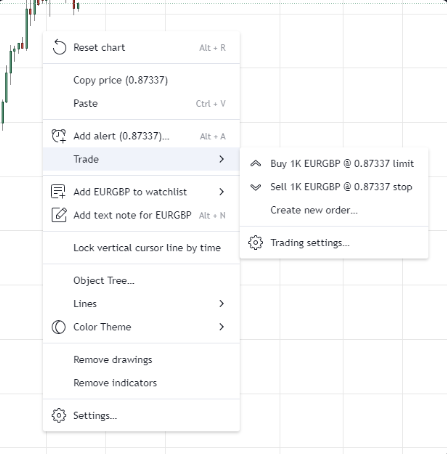

One of the main advantages of TradingView over Autochartist is its ability to execute trades. While Autochartist can highlight a potential trade and give you information about possible changes, it is the trader who has the final say about opening and closing positions. With TradingView, by contrast, you can see the buy/sell button directly on your chart. You can also place limit or stop orders directly from your charts.

The other advantage of TradingView is that you can interact with other traders, follow their ideas or even post your own ideas – an option that is not available on Autochartist.